What are the benefits of the KrisFlyer UOB Credit Card?

With so many options to choose from, how do I review the KrisFlyer UOB Credit Card if I don’t ask for your perspective as I am doing now, who can offer some insights into the benefits of the card?

Products mentioned in this forum:

No Name

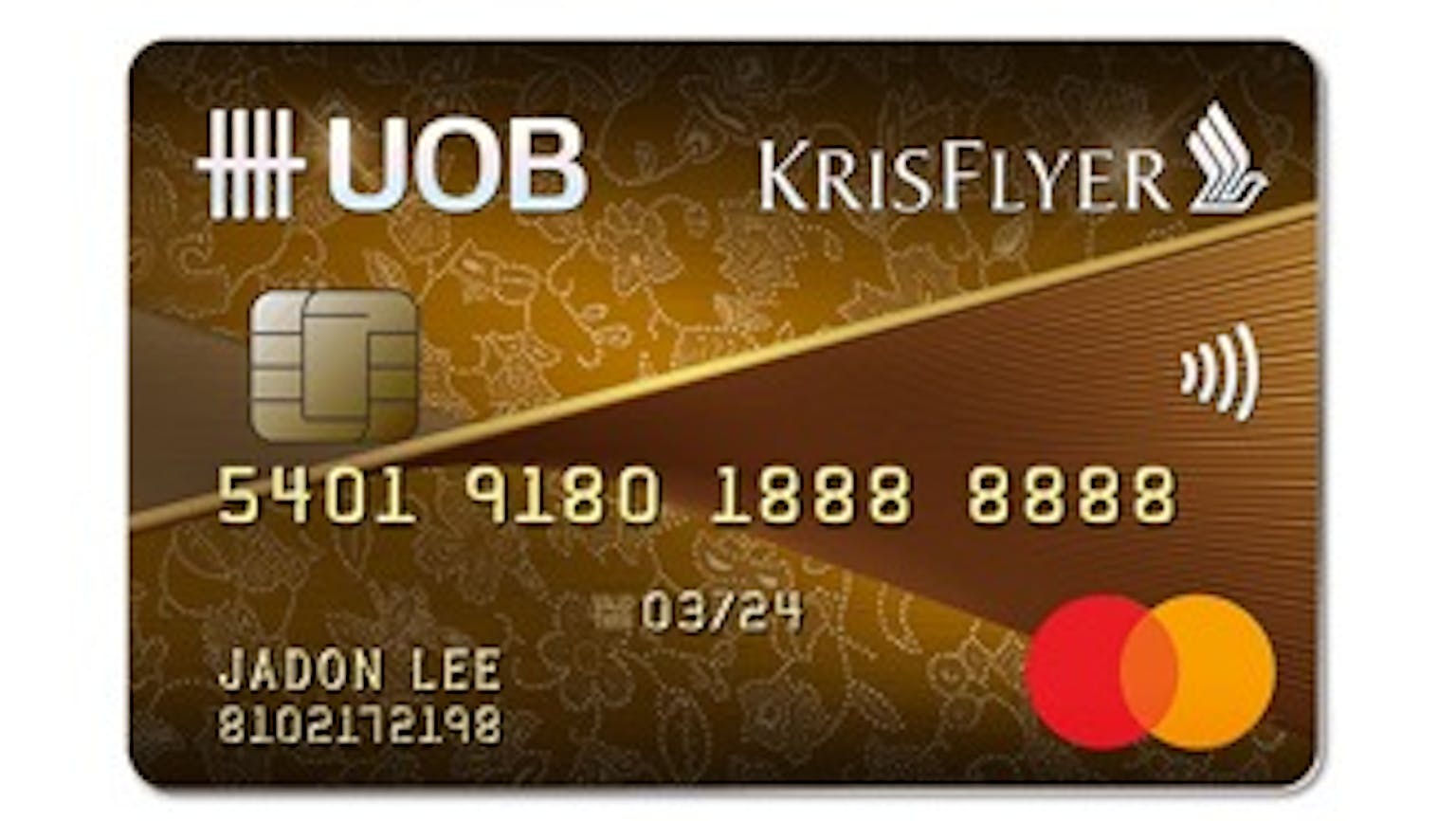

The KrisFlyer UOB Credit Card makes everyday purchases quicker and safer with just a tap via MasterCard Contactless, or through your mobile device via UOB Mighty Pay or Apple Pay. With a convenience of eStatement, faster, easier and paperless access to your monthly bank and card statement. You get to pay for your bus and train rides, emjoy more convenience with SimplyGo with no need for top-ups, no need for multiple cards, enhanced security safeguarding your online purchases of up to USD200 with MasterCard e-Commerce Protection. You also get notified when transactions are made with SMS alerts while the EMV Smart Chip protection guards you against "skimming" and unwarranted cash transactions, with zero liability on unauthorised charges when you notify the Bank of lost or stolen card. Even more, it helps with spend control aiding to keep track of your spending on the go. Finally they offer complimentary personal accident coverage and emergency medical assistance of up to S$500,000