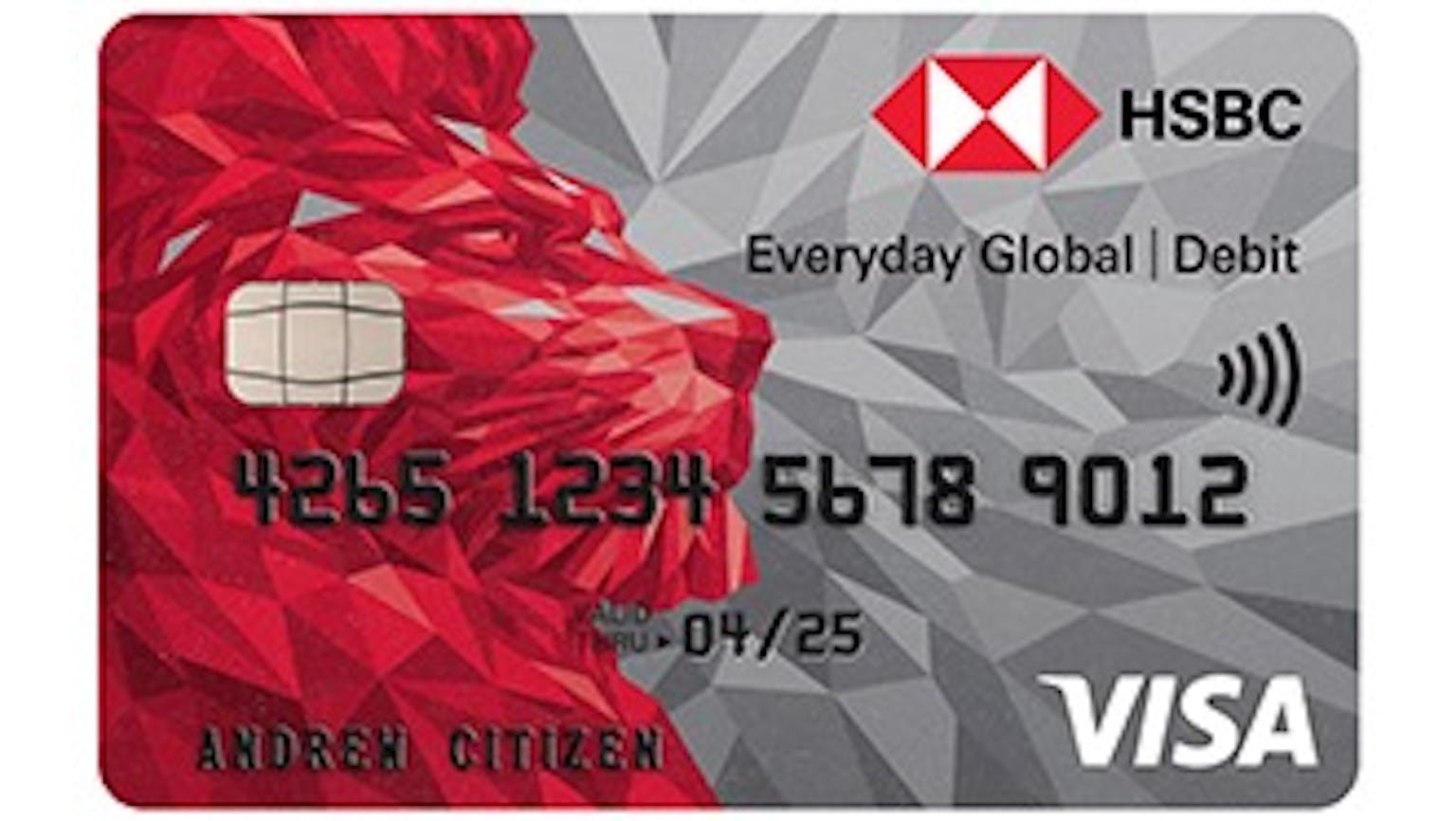

How does the HSBC Everyday Global Debit Card work, do I get to enjoy no FX fee on my overseas purchases and cash withdrawal?

I am looking to checkmate on the headaches of exchanging money in Singapore for an overseas holiday and I just want to ensure to get the best rates. Can I have a good deal with the HSBC Everyday Global Debit Card?

No Name

Yes you can have a good deal, simply fund your HSBC Everyday Global Account with the foreign currencies that you intend to spend and transact with your HSBC Everyday Global Debit Card, and they will deduct the same transacted amount from your account without any FX fee. For example if you are buying an item for USD200, they will deduct USD200 from your HSBC Everyday Global Account with no hidden charge. And in the instance that you do not have sufficient foreign currencies in your account, they will convert and charge your transaction amount in Singapore dollar.