Who can recommend a card that is Preferred for use in China?

I am planning a trip to Beijing and I would like to hear which debit card I can use in China for convenience? I hope to do a lot of shopping and entertainment on the side and would prefer a card with good deals and benefits. I am grateful for your help.

No Name

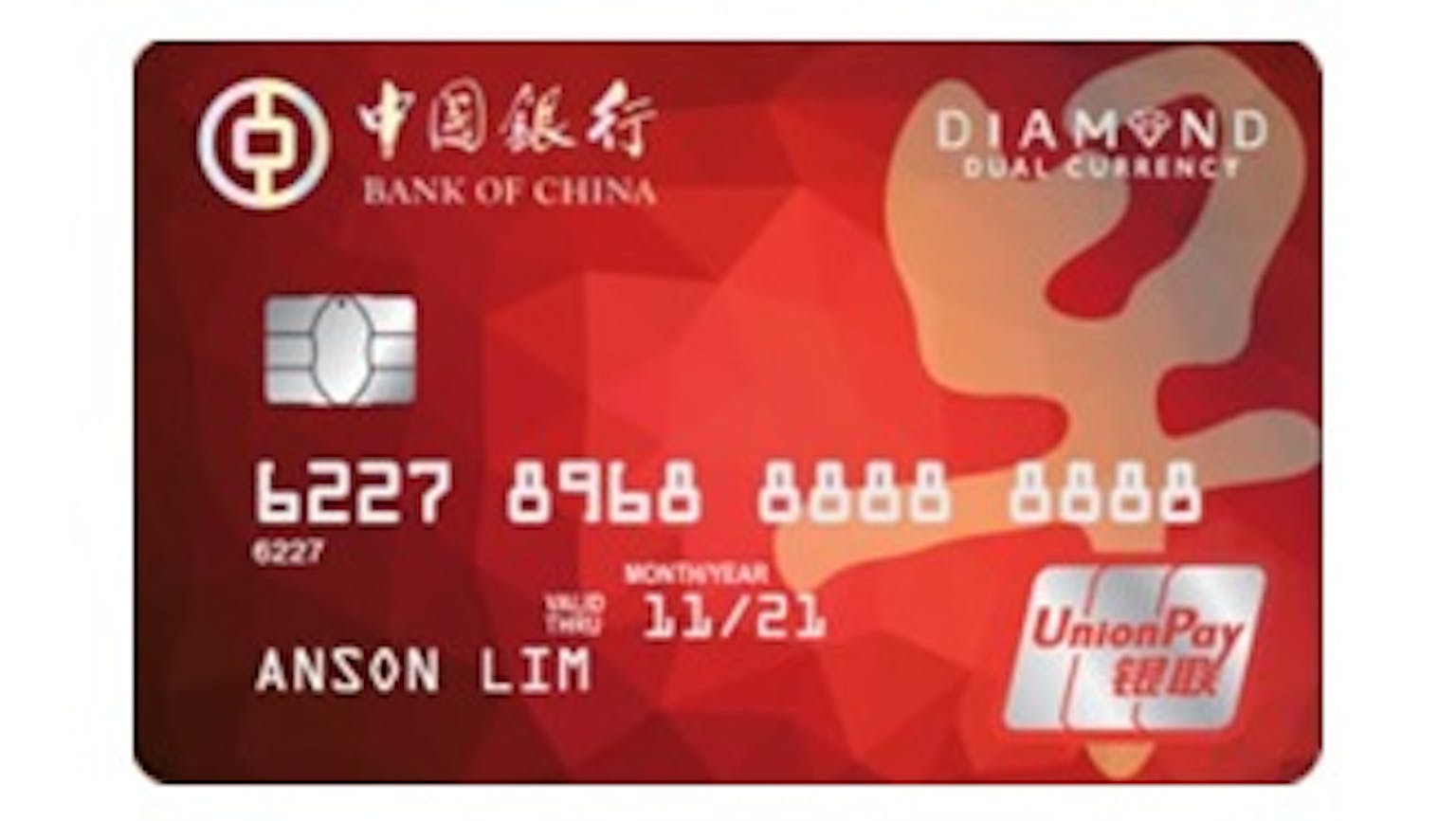

I can gladly recommend the BOC Zoabao Debit Card as you can enjoy ticketing privileges to selected events like forums, workshops, fairs and performances under SPH Chinese Media Group and its media brands with zero currency exchange fees for all RMB transactions through your RMB account. No transaction fee for your cash withdrawals at over 24,000 BOC ATMs in Mainland China, for a limited time only. Additionally you can enjoy payment convenience with UnionPay, the largest payment network in China. They also offer enhanced card protection with EMV chip to allow 24-hour SMS notification for your transactions. Furthermore there are no annual fees ever with the card with an efficient online banking system which allows you to view your transaction details, change daily transaction limits and activate overseas usage on your debit card via BOC Personal Online Banking.