Will I be reminded to choose my Bonus UNI$ category every quarter before due date?

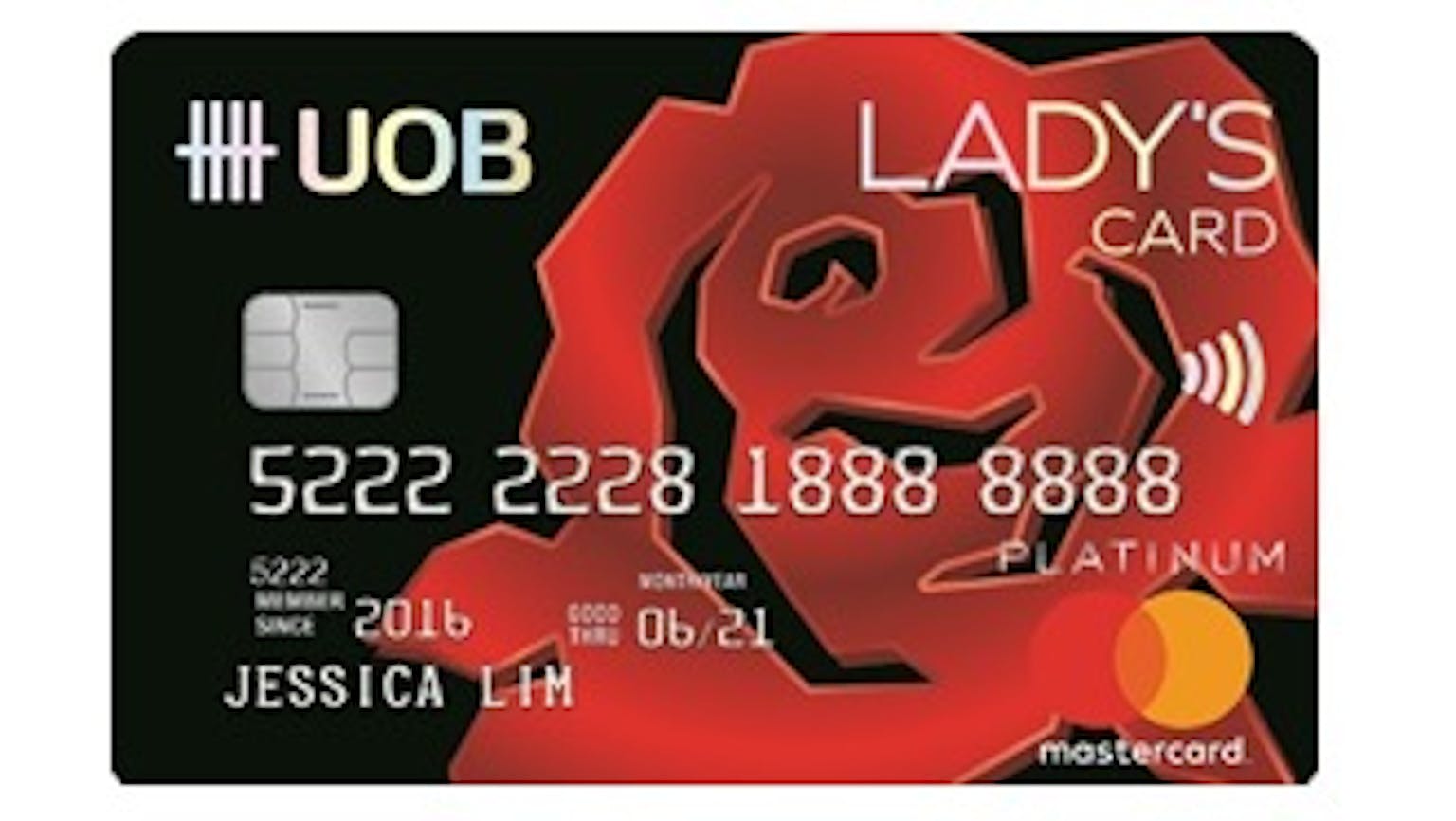

Will I be reminded to choose my UOB Lady’s Debit Card Bonus UNI$ category every quarter before the due date and how can I confirm that I have chosen my Bonus UNI$ category?

Products mentioned in this forum:

No Name

Affirmative! You will receive a reminder SMS sent to the mobile number which you had used to register with the Bank to select your preferred category one month prior to the start of each new quarter. In addition you can call the Card member service phone number printed on the back of your UOB Lady’s Card and a customer service advisor will be available to assist you.