Will I enjoy all the discounts and privileges offered by OCBC and Esso service stations if I pay and earn Smiles points using this card?

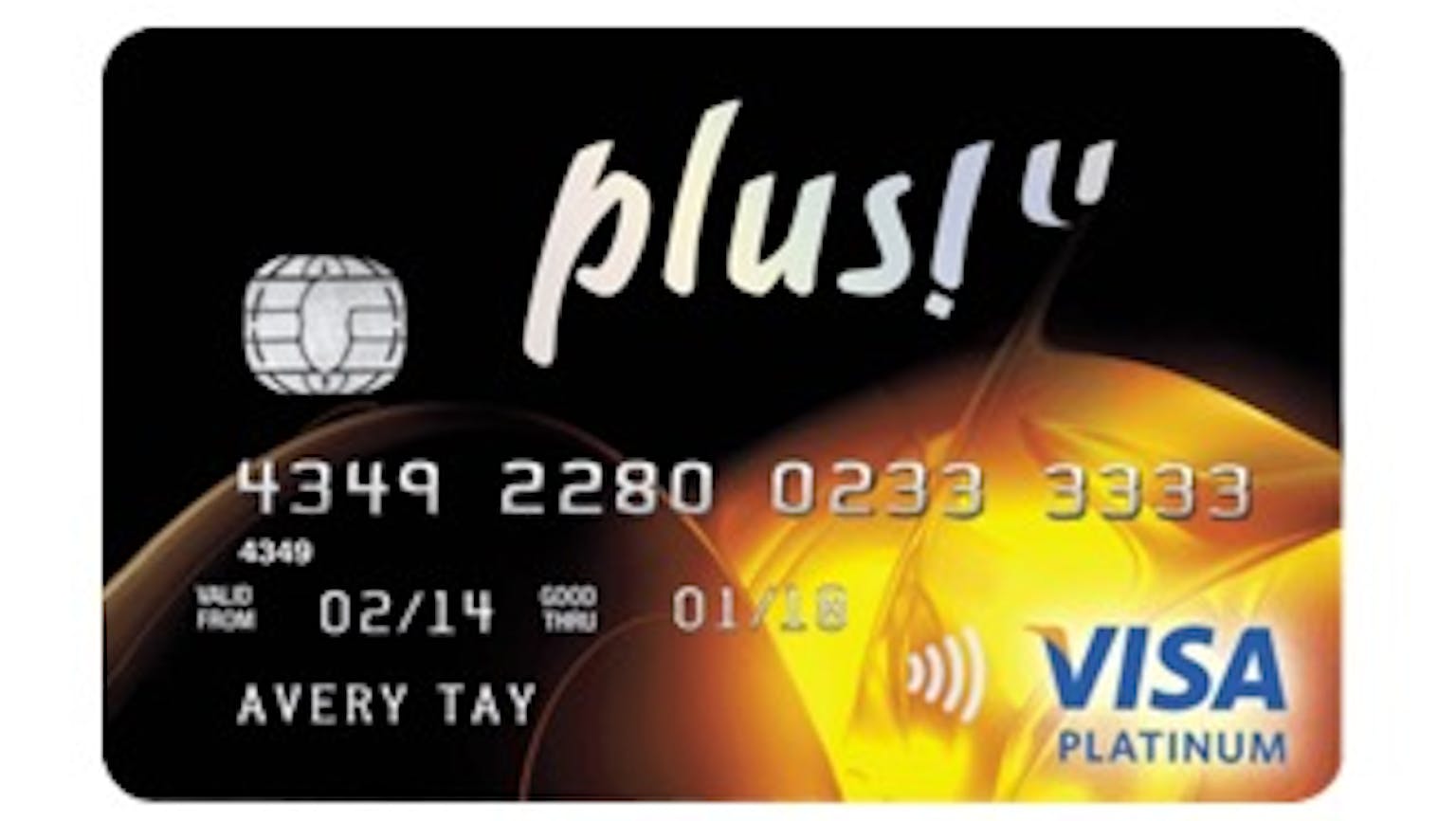

What is the Plus! Visa and Smiles 2-in-1 Programme all about and do I get to enjoy the discounts and privileges offered by OCBC and Esso service stations if I pay and earn Smiles points using this card?

No Name

The NTUC Plus! Visa credit card and Smiles 2-in-1 Programme simply allows a NTUC/OCBC Plus! Visa card to be linked to an Esso Smiles Account. By creating a new Smiles Account and linking it to a NTUC/OCBC Plus! Visa card, the card member can use his Visa card to pay for fuel and earn Smiles points using one card. You will receive 0.2% LinkPoints based on your gross fuel spend and Smiles points equivalent to 2.5% fuel savings will be awarded when 250 litres of Synergy fuel are purchased within a calendar month using the same Smiles card.