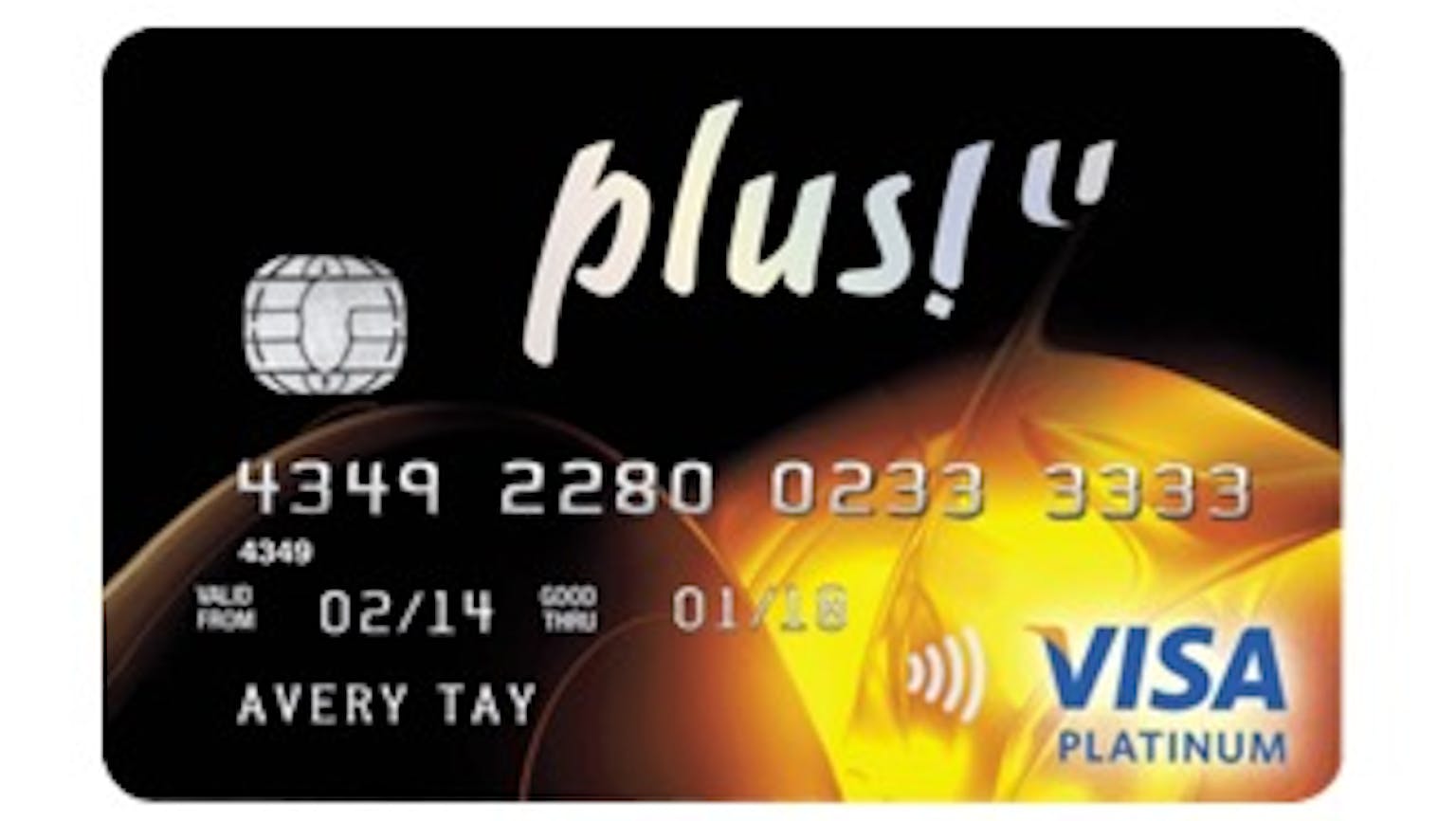

My son just turned 21 years, what are the highlights of an NTUC/OCBC Plus! Visa Credit Cards? My husband and I want to gift him one.

My husband and I want to gift our son who just turned 21 with the credit card in addition to the birthday car gift he received. Would this card be good for him?

No Name

The highlights include a 12% off everything at Fairprice with salary credit and up to 18.5% fuel savings which should be perfect for him considering the car your husband bought for him but note that aside from being 21 years to be eligible, he needs to have above $30,000 annual income. The interest rate for NTUC/OCBC Plus! Visa Credit Cards is 26.76% per annum and if they dont receive full payment by the due date, there will follow a minimum charge of $2.50 a month, calculated from the transaction date.