POSB Everyday Card offers families and average spenders a convenient way to earn cashback for diversified spend. Consumers earn rebates on dining, groceries, petrol, health and wellness, transport, and even recurring bills which are often excluded from cashback rates. Although some rates apply only to specific merchants, they are mostly big brands offering up to 20.1% petrol savings with SPC, 15% rebate with Parking.sg, 5% with Gojek, Ryde, & Comfort del Gro, 5% at Sheng Siong, and 3% on wellness products at Watsons. Consumers also earn 1% cash rebate on recurring bills with select merchants, but earnings are capped at just S$1 per month, which is quite low.

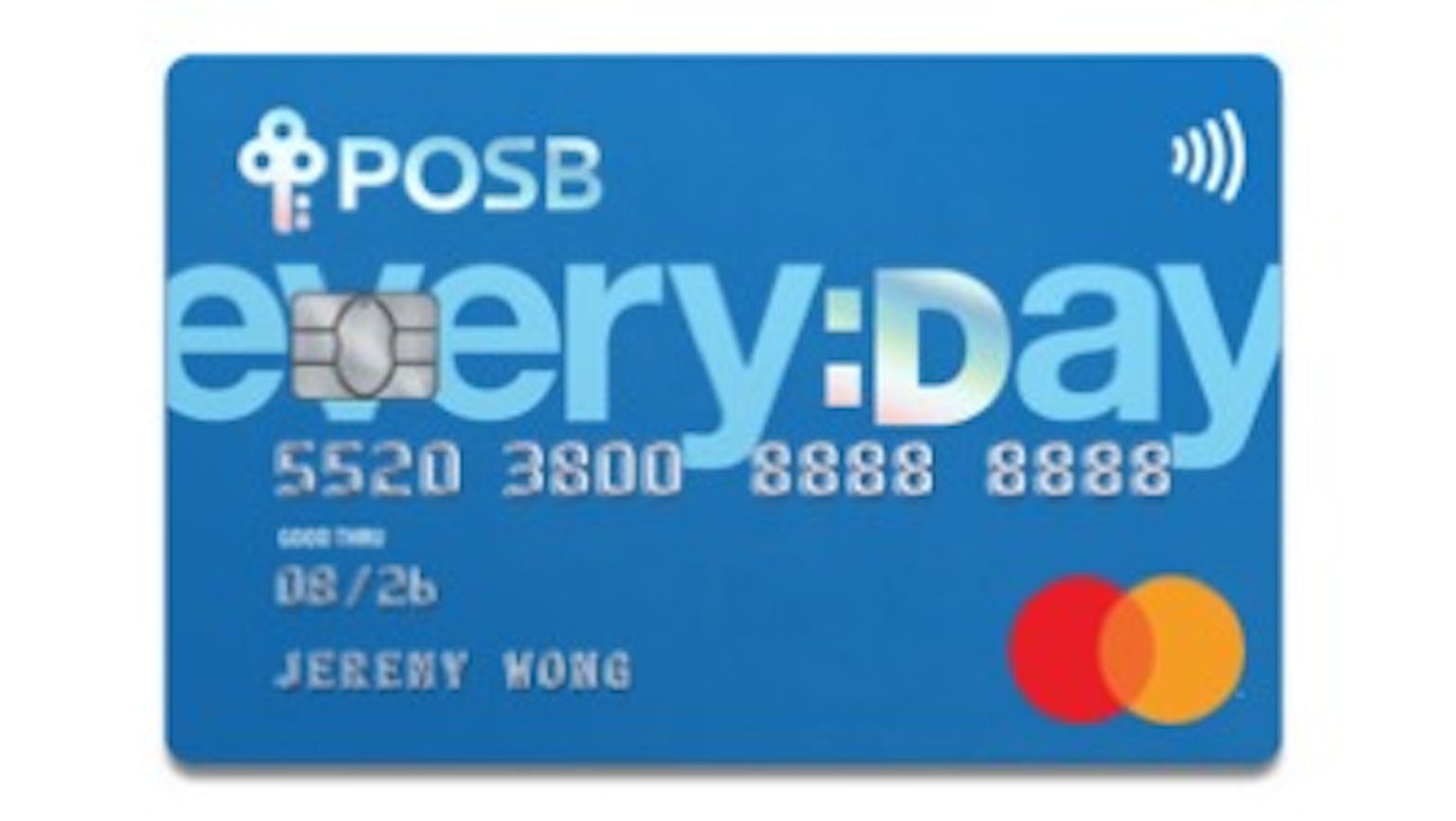

No Name

There is not much difference if you decide to use it as EZ Link or use it to top up another travel card. Both ways you get to clock your credit card spending assuming you use the POSB everyday card to top up your other travel card. In my case, My POSB Everyday card is used as an EZ Link card and has auto top-up. The only cons of using POSB Everyday card as EZ Link, is that if you cancel the card, then you have to set up another EZ Link auto top up again. Other than that there really isn't much benefit or difference and it’s up to personal preference. I am just lazy too carry around so many cards.