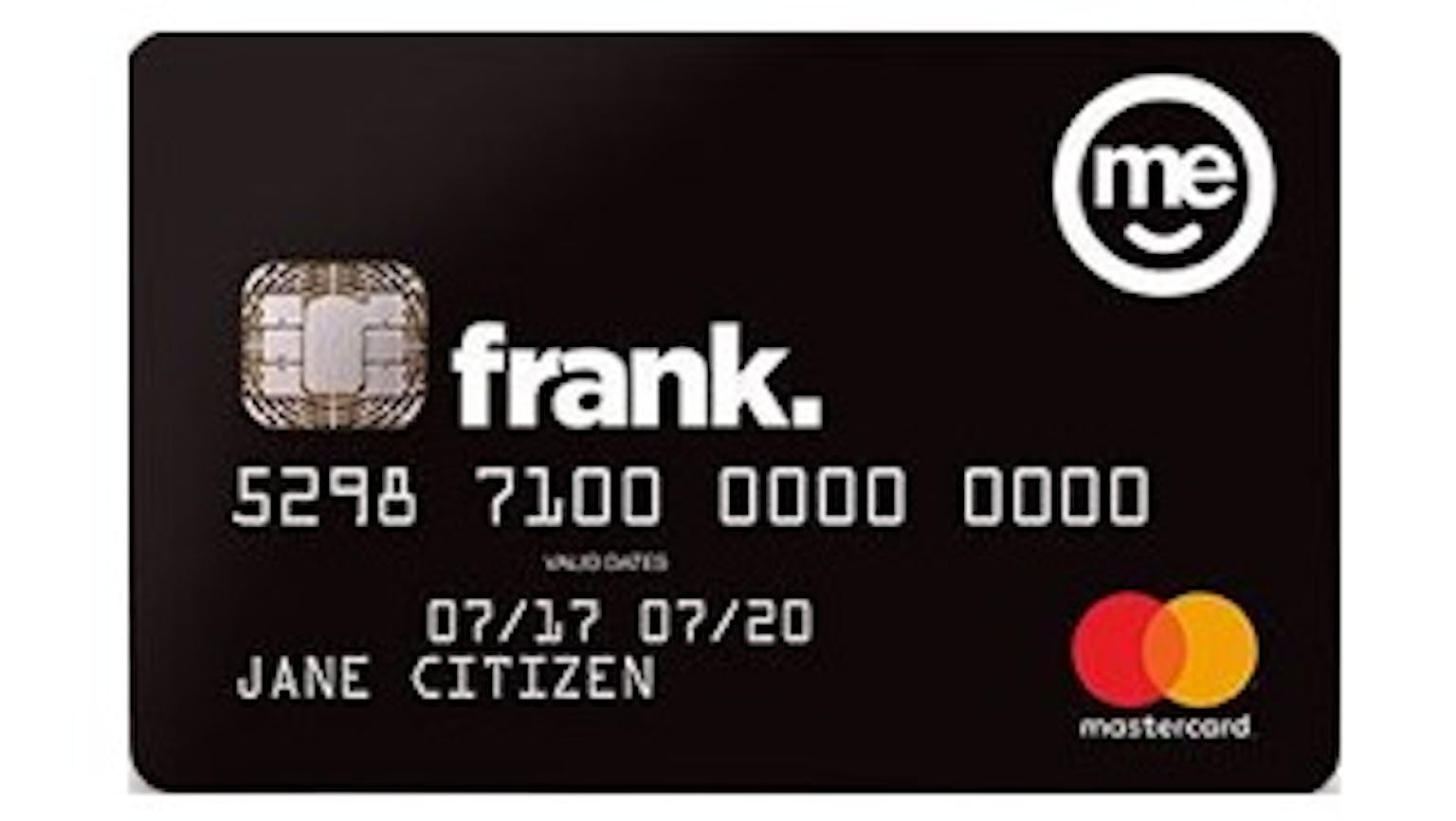

Would $100 invested monthly for a blue-chip via the OCBC Frank Card be a smart move?

I want to invest $100 monthly into a blue-chip through OCBC Frank but I gather there is a monthly fee of $5. Would I be making a loss by investing only $100/month or should I put in more money?

Products mentioned in this forum:

No Name

Please note that OCBC Monthly Investment plan is too expensive for someone who wants to invest just $100 a month. I believe a $5 out of $100 is way too expensive and you should look to increase the size of your investment or look for other monthly investment plans out there. I remember my start out amount was $500 per month and OCBC only charge me the first $5 transaction only. Subsequently, I was not charge for more $5.