What is the Auto-enrolment with the Esso Smiles Driver Rewards programme?

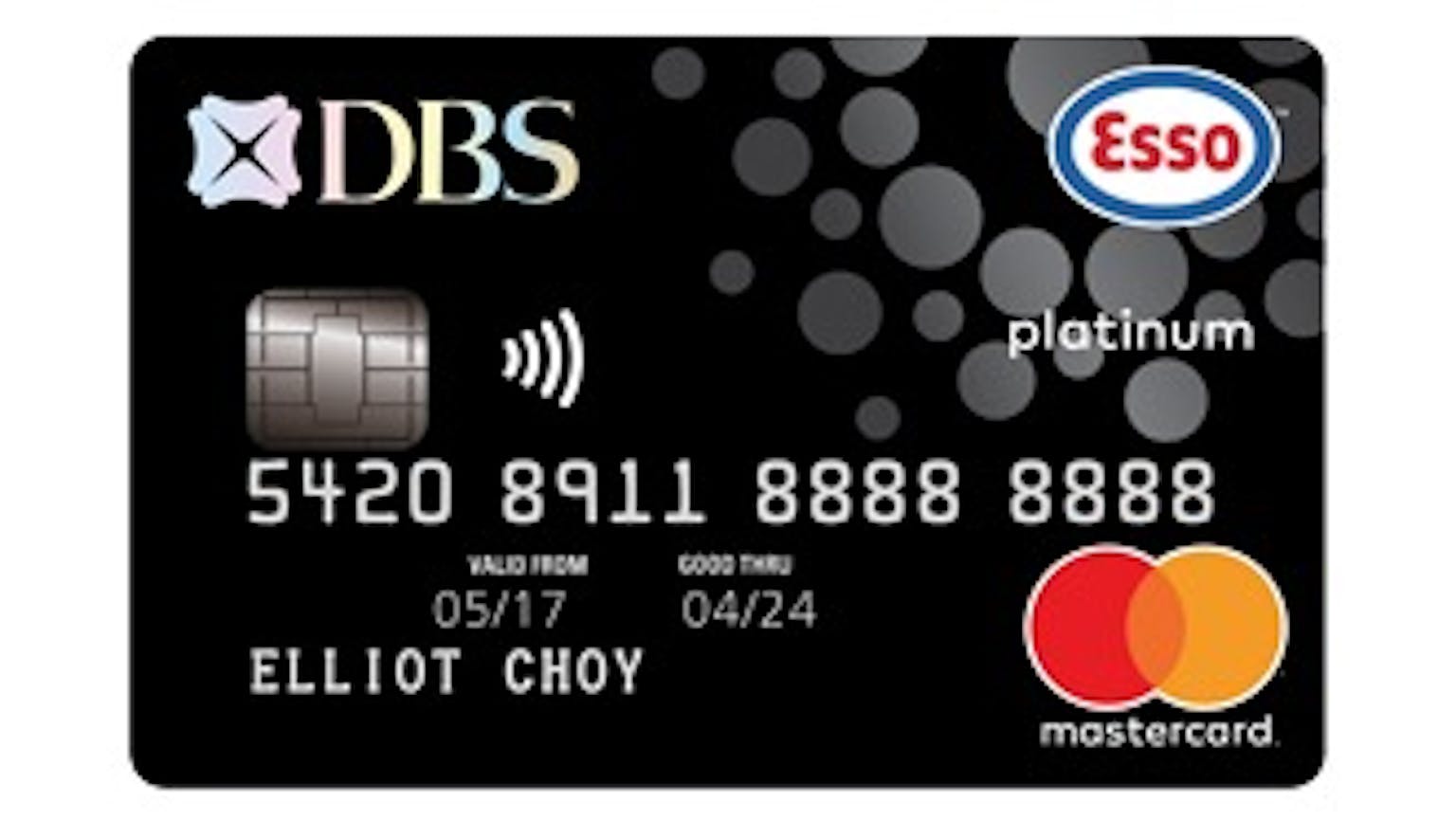

I hear that the DBS Esso Card is a great fuel savings card especially as they offer up to $120 fuel savings when one apply for DBS Esso Card. What else do you think I ought to know about this card and the Auto-enrolment into Esso Smiles Driver Reward Programme?

No Name

I know a little bit about Auto-enrolment into the Esso Smiles Driver Rewards programme. This loyalty programme for Esso customers in Singapore gives you equivalent of up to 2.4% in additional fuel savings. First of all you can earn 1 Smiles Point for every litre of Synergy fuel purchased at any Esso station and S$10 instant fuel redemption with as low as 300 Smiles Points earned or up to S$30 instant fuel redemption with 750 Smiles Points earned.