What is the exchange rate used to convert my foreign currency transactions to local currency if I use my card when I am overseas?

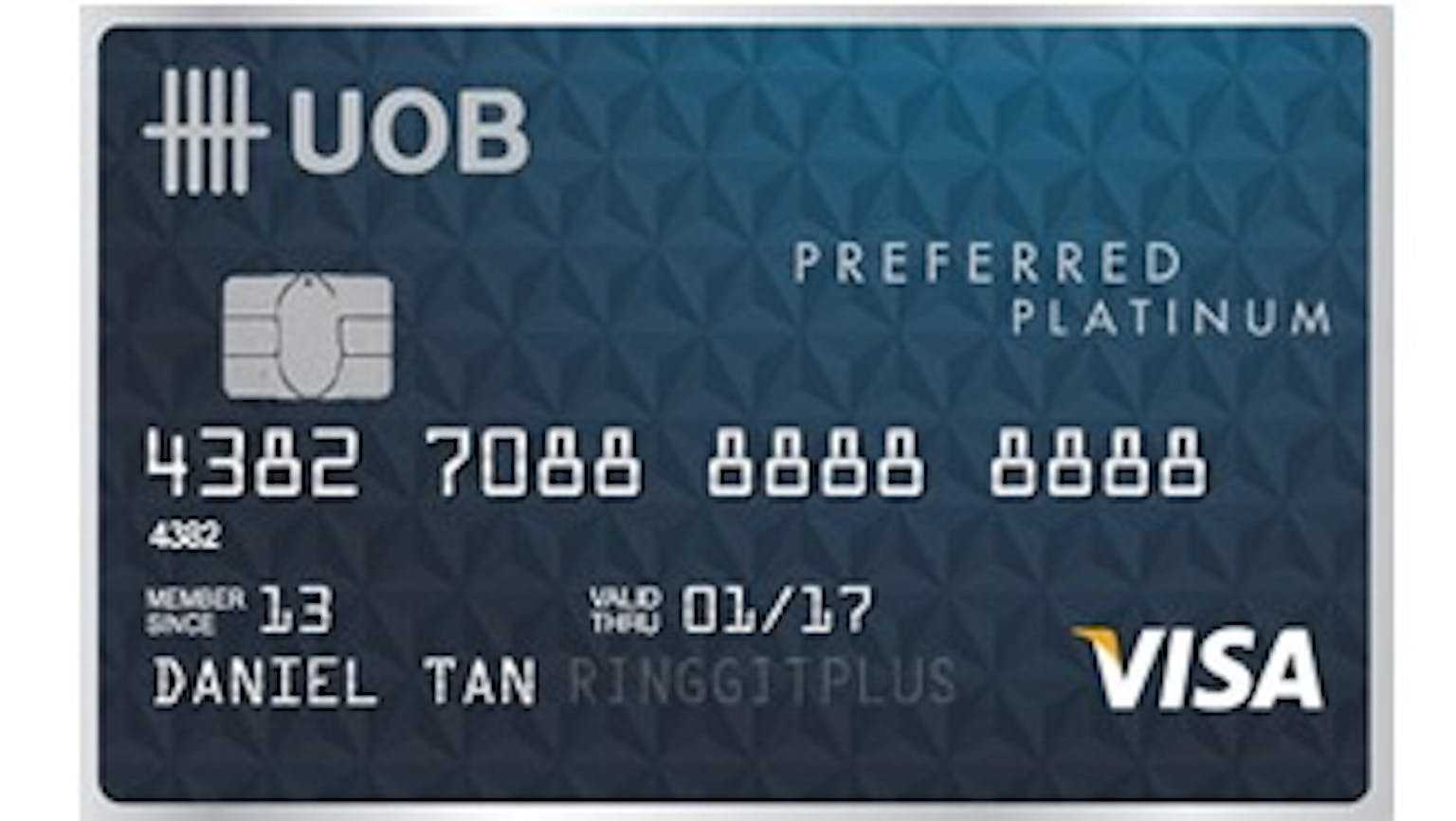

I have a UOB preferred platinum visa card that has been lying idle for a few months and I have an upcoming overseas trip in 3 weeks, when I use my card overseas what is the exchange rate used to convert my foreign currency transactions to local currency?

No Name

The exchange rates used to convert foreign currency transactions into Singapore dollars may vary from day-to-day and is also dependent on when the transactions are submitted for processing by the merchants. Furthermore, foreign currency transactions are subject to a foreign currency administrative fee levied on the Singapore dollars amount converted.