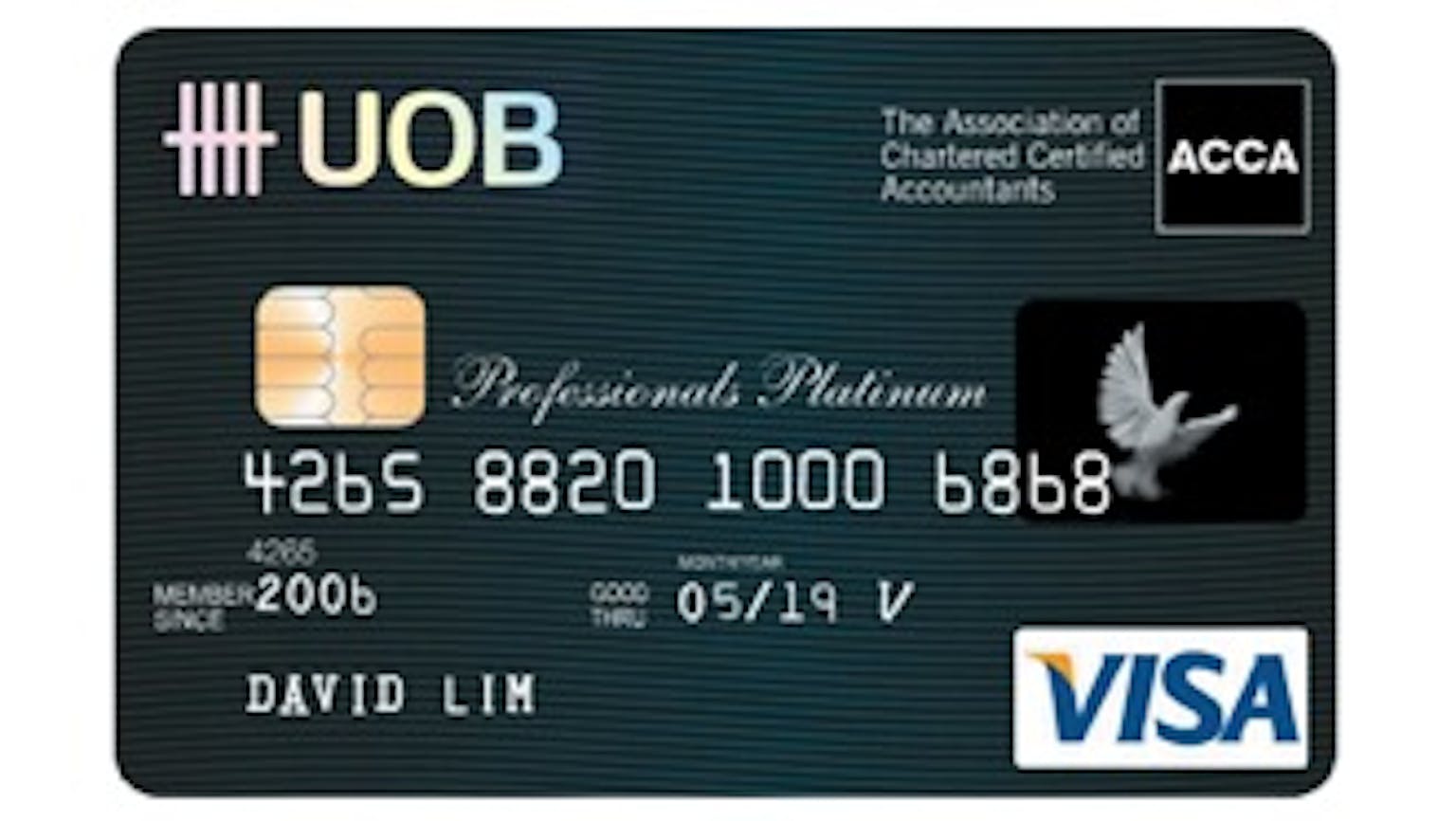

Can I apply for the UOB professionals platinum card if I am not a professional? but over 21 can i apply for the card?

I am 23 years old but not exactly a professional as would be generally considered but a freelancer, can I apply for the UOB Professional Platinum Card still?

No Name

No you can’t, unfortunately all applicants must be an existing member of either Alumni Association Institute of Singapore Chartered Accountants (ISCA), Law Society of Singapore, Singapore Medical Association (SMA) and the Association of Chartered Certified Accountants (ACCA).