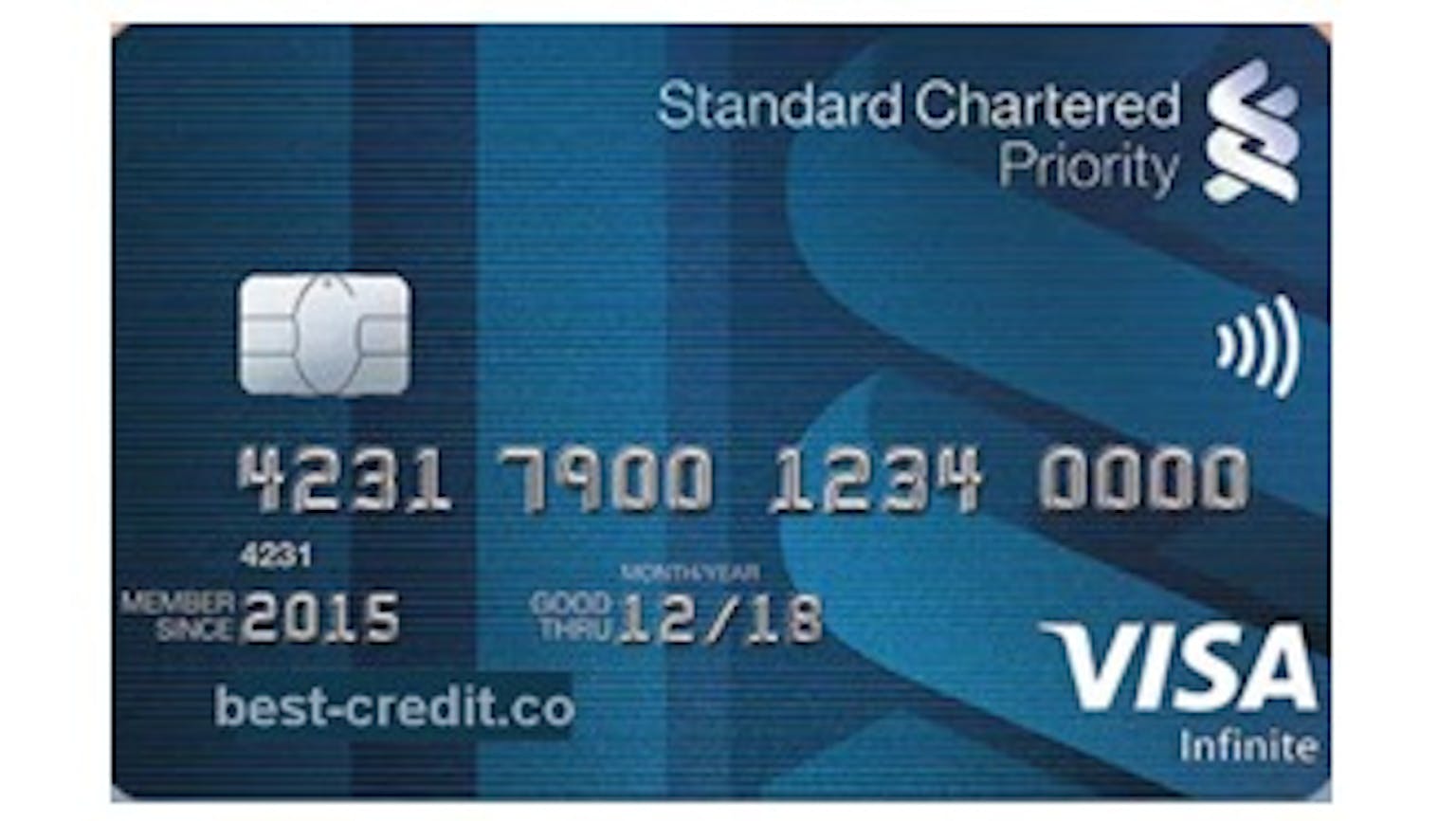

Is it confirmed true that the 360º Rewards Points offered by SCB Priority Visa Infinite Credit Card never expire?

Does anyone currently use the SCB Priority Visa Infinite Credit Card, can you confirm if it is true that the 360º Rewards offered by the card do not ever expire?

No Name

Yes it is true, it is ultimately a truly rewarding relationship were you can now earn 360º Rewards Points faster and easier than with any other card because the bank understands to reward you not only on your credit card spend but also on your existing portfolio of accounts held, including savings, mortgage and selected investment products. So yes the 360º Rewards never expire but you have to only spend $500 per month to enjoy the total banking relationship 360º Rewards Points offers. The 360º Rewards Points will be credited to your card every month.