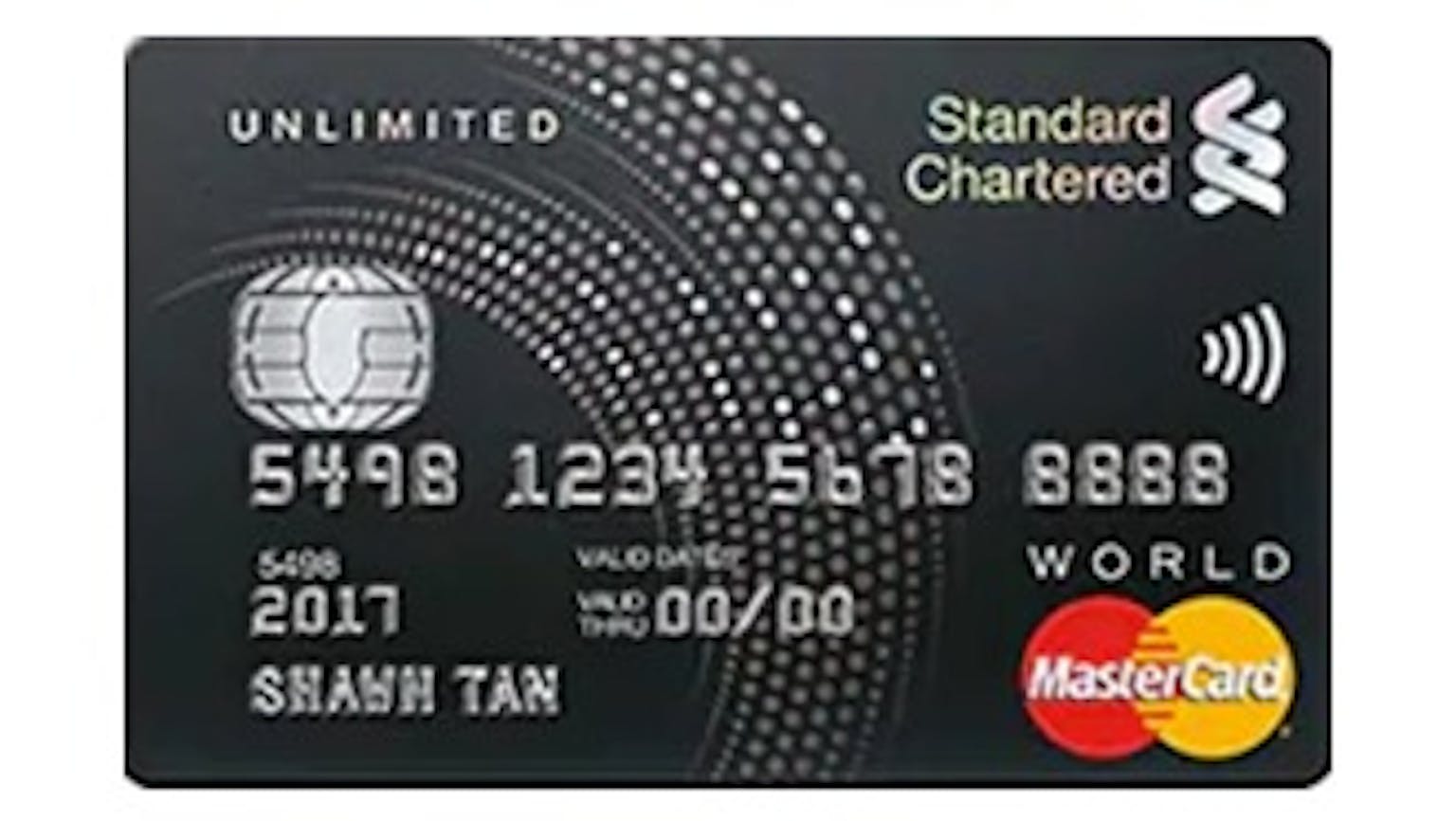

Are all online transactions not eligible for cashback with the Standard Chartered Unlimited Cashback Credit card?

I hold a Standard Chartered Unlimited Cashback Credit card, and I am eligible to get 1.5% cashback. However, it appears this cashback did not take into account the premium paid for my annual Personal Accident Insurance policy. Are all online transactions only for insurance-related transactions?

No Name

I suggest you check the terms and conditions of your card properly as usually, insurance premiums, in addition to most bills such as mobile/hospital bills, are not eligible for cashbacks. Most merchants seldom accept them now so you are right to assume that most premiums are excluded for rebates. Nonetheless they do accept the amount for minimum spending, I advise you check directly with the bank