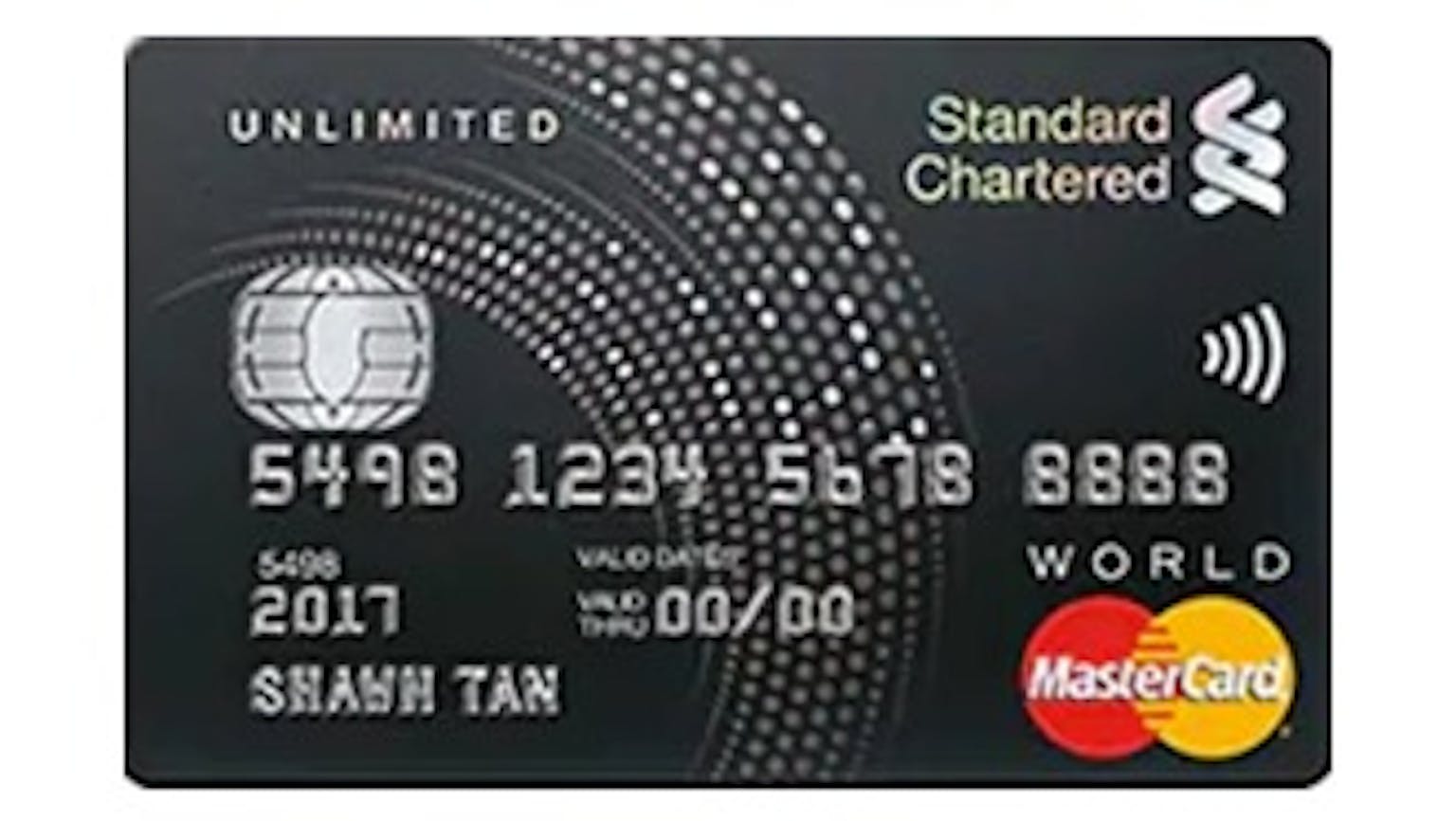

I own a Standard Chartered Unlimited Cashback Credit card presently, but it did not take into account the premium paid for my annual Personal Accident Insurance policy. Does it mean that all online transactions are not eligible for cashback?

I currently have a Standard Chartered Unlimited Cashback Credit card, and is eligible to get 1.5% cashback. However, this cashback did not take into account the premium paid for my annual Personal Accident Insurance policy. Are all online transactions not eligible for cashback? Or only for insurance-related transaction

No Name

I am not sure about ‘all’ online transactions not eligible for cashback but I know that any insurance premiums charged to your Unlimited Card and/or your supplementary credit card are NOT eligible for a cash back scheme. I advise you have a second look at the terms and conditions of your card properly. Usually, insurance premiums, as well as most other bills such as mobile/hospital bills, are not eligible for cashbacks