Who can recommend the best miles card fit for a jetsetter who is equally conscious of clocking miles?

I am about to begin travelling around a bit on business trips and in that instance considering clocking and accumulating miles thus I need a card that lets me to earn miles with no minimum spend.

No Name

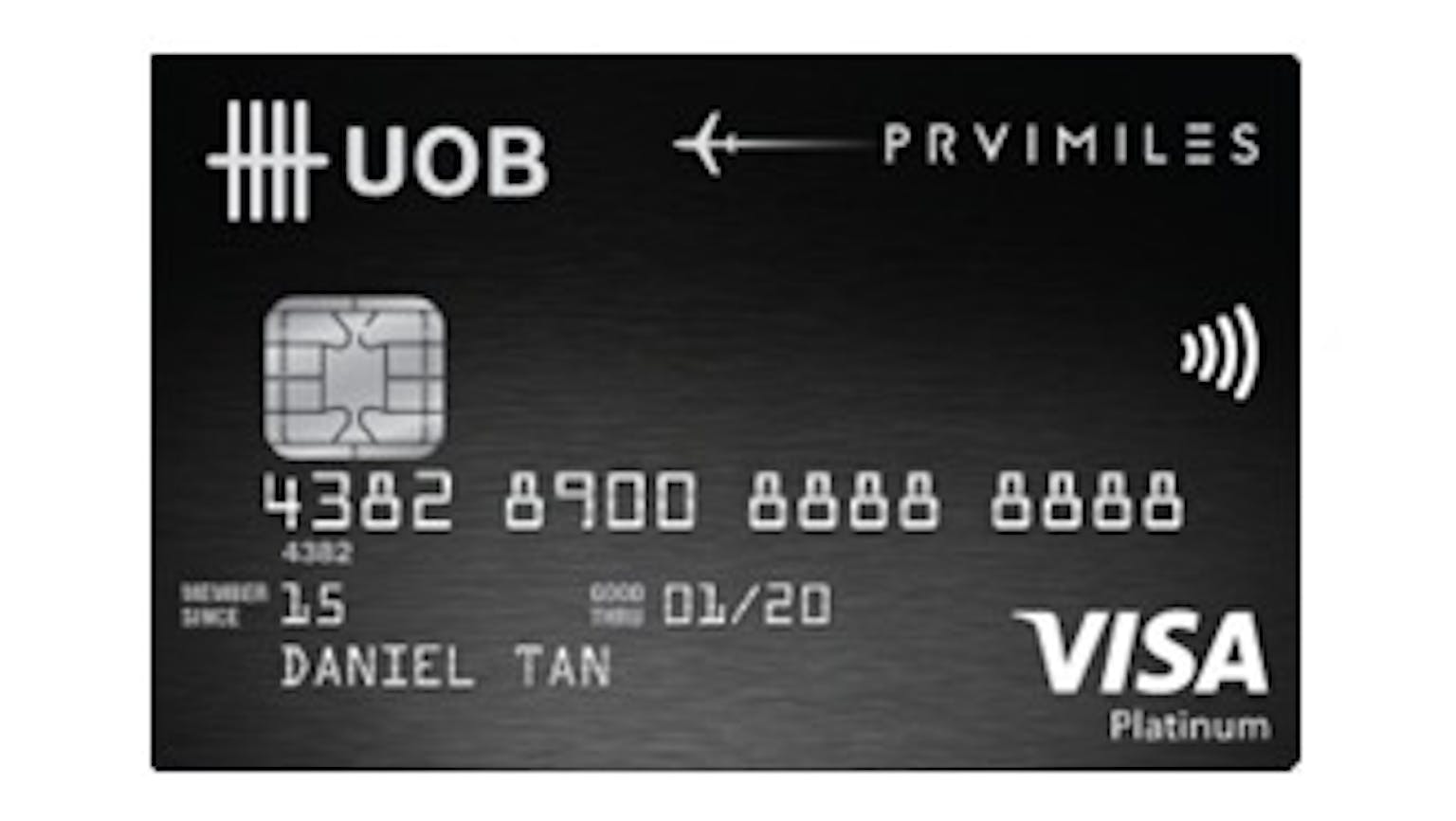

I think the UOB PRVI Miles fits that bill, you get for starts S$1501 when you sign up and can earn 1.4 miles per S$1 spend on your bus and train fares. Considering that you are about to begin jet setting, you can enjoy with this card complimentary airport limousine to Changi Airport. Access to UOB PRVI travel butler for comprehensive travel assistance and coverage on travel insurance and inconvenience. And speaking of miles benefits, you stand to get 6 miles per S$1 spend on major airlines and hotels worldwide, 2.4 miles for every S$1 spent overseas, 6 miles for every S$1 spent on major airlines and hotels through Expedia, Agoda and UOB Travel.