What are the terms and conditions for the UOB PRVI Miles Card in regards to miles and bonuses?

What are the terms and conditions for the UOB PRVI Miles Card in regards to miles and bonuses for every S$1 spent on major airlines and hotels booked through its partners?

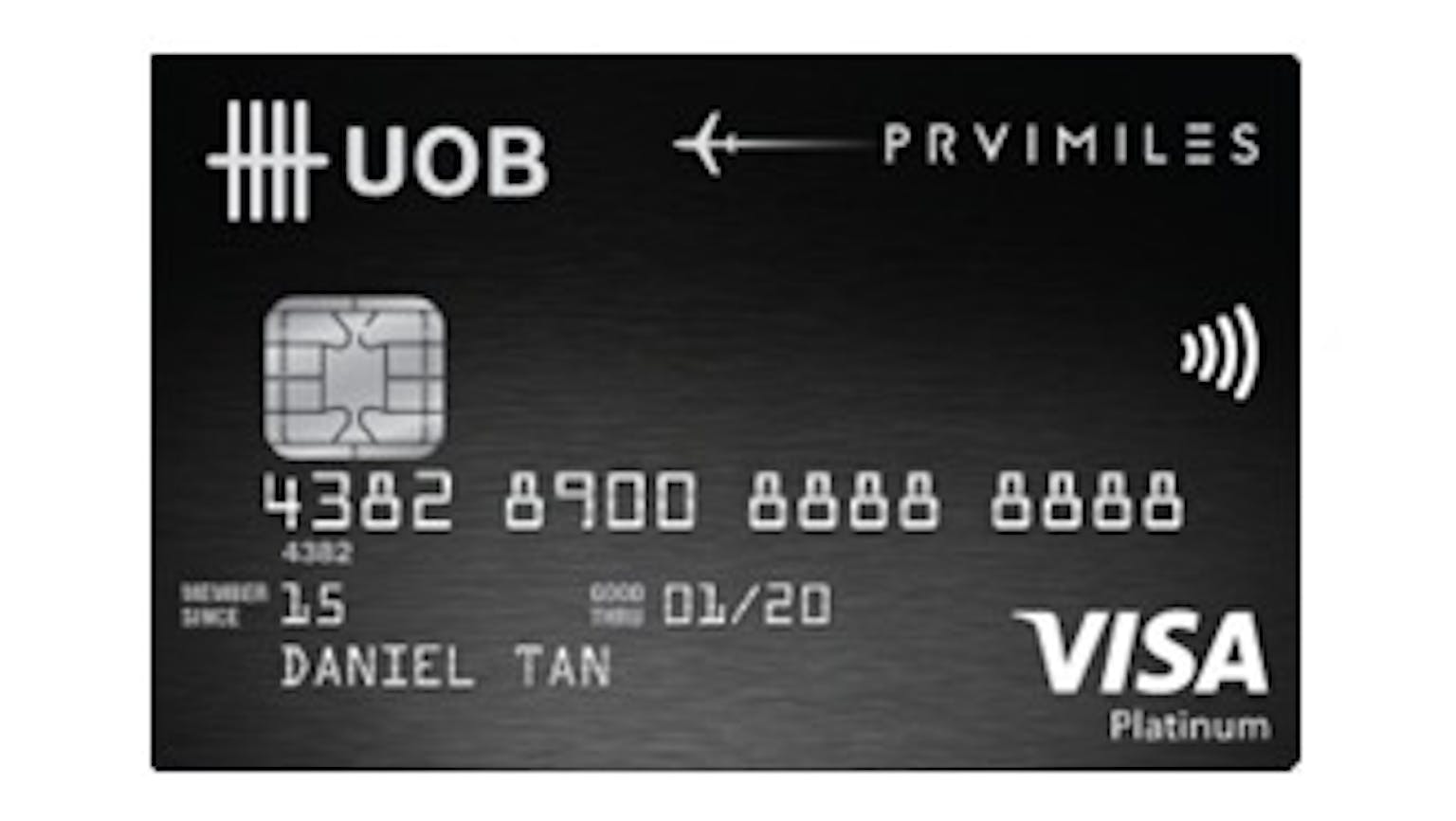

No Name

Basically you receive 6 miles for every S$1 spent on selected travel partners. Card members will earn UNI$15 for every S$5 spent (equivalent to 6 miles for every S$1 spent) on corresponding Qualifying Transactions for each of the travel partners as described below. The rate of UNI$15 for every S$5 spend on Qualifying Transactions comprises of local spend for every S$5 spent, prevailing earn rate of UNI$3.5 and bonus earn rate of UNI$11.5; or overseas spend for every S$5 spent, prevailing earn rate of UNI$6 and bonus earn rate of UNI$9; depending on the currency and payment gateway effected on the Qualifying Transactions. The bonus UNI$ is not valid in conjunction with other promotions however and qualifying transactions exclude refunded, disputed, unauthorised or fraudulent transactions and UOB reserves the right to revoke, deduct and/or re-compute any UNI$ in the event that Card members cancel, reverse and/or revise transactions