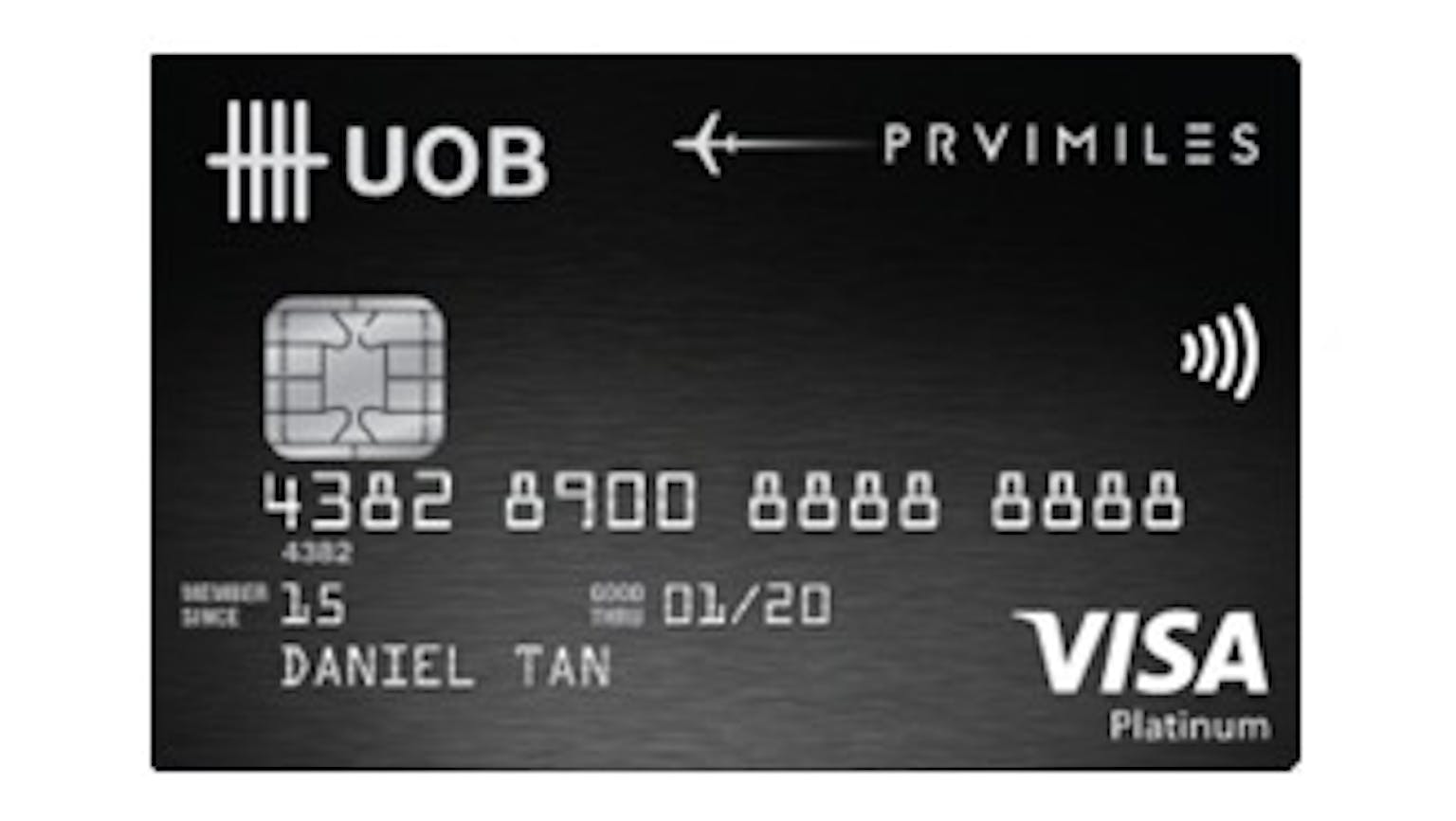

Do you know what UOB PRVI Miles Card airport and travel privileges package look like?

So am finally going to make my first trip overseas and to Hong Kong in particular, does the UOB PRVI Miles card offer transfer and travel pecks to enhance my experience?

No Name

Although UOB PRVI Miles Card offers many more benefits and pecks, I will point out two as they have to do specifically with travel. UOB PRVI Miles Card offers complimentary airport transfers to Changi Airport for UOB PRVI Miles American Express Card members. Secondly they also offer travel insurance in the form of complimentary personal accident coverage and emergency medical assistance of up to $500,000.