What happens to my existing GIRO, instalment payment plan and/or recurring payment arrangements when it comes to the renewal or replacement of the UOB PRVI Miles Card?

As it relates to the renewal or replacement of the UOB PRVI Miles Card, what will be the outcome of my existing GIRO, instalment payment plan and/or recurring payment arrangements?

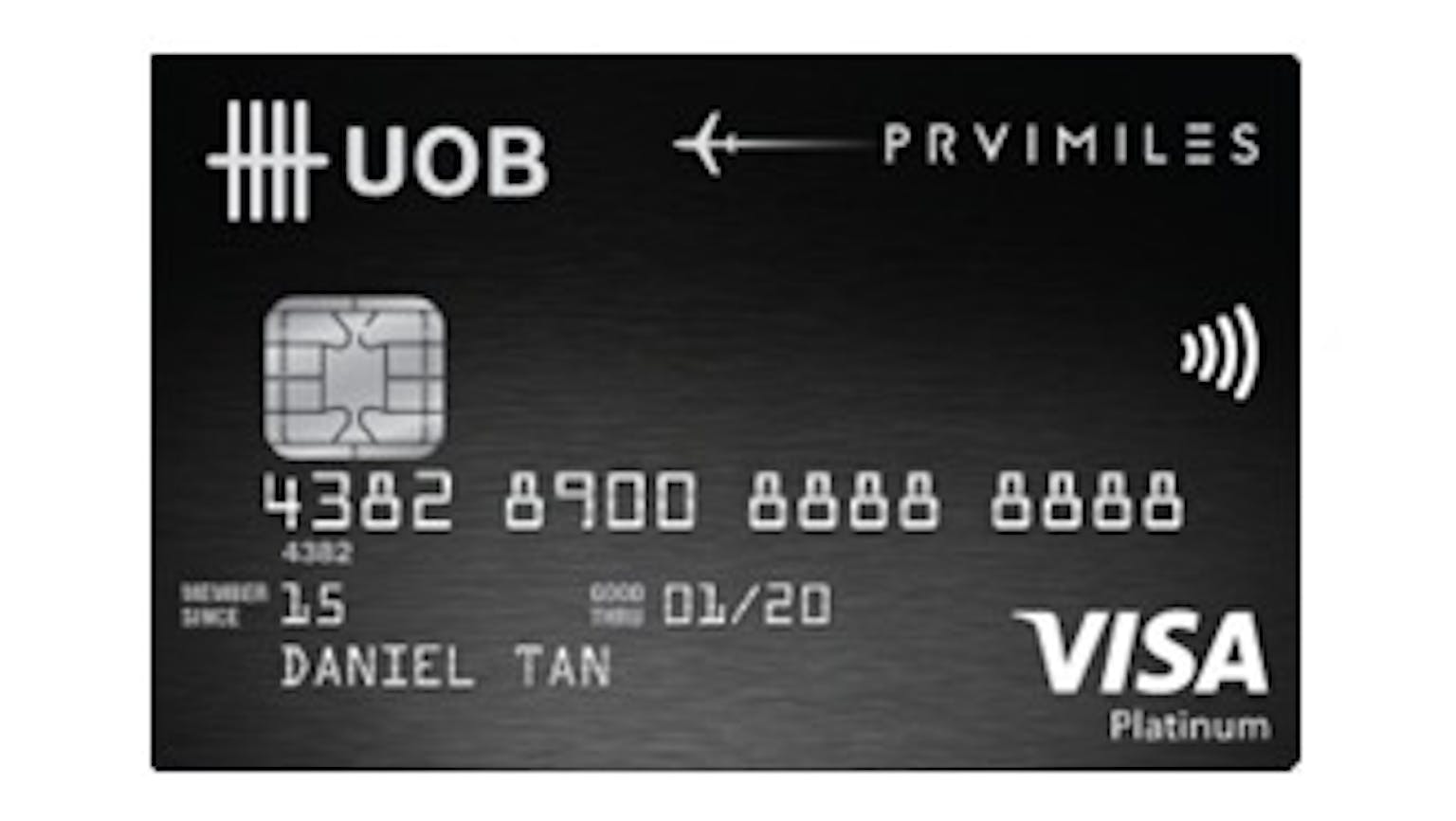

No Name

Actually all the mentioned arrangements will remain unchanged but your new Card’s expiry date will be different, so it is advisable to inform the respective merchants, where the credit/debit cards expiry date is necessary for authenticating any credit/debit card. Card activation will still be required to be completed before any transaction can be charged at any point-of-sale terminals.