In what countries can my UnionPay Card be accepted by merchants and ATMs?

Can UnionPay Cards be accepted in New Zealand, we plan a family vacation there and I was hoping that my UnionPay card will be resources at that time, can someone confirm if it can please?

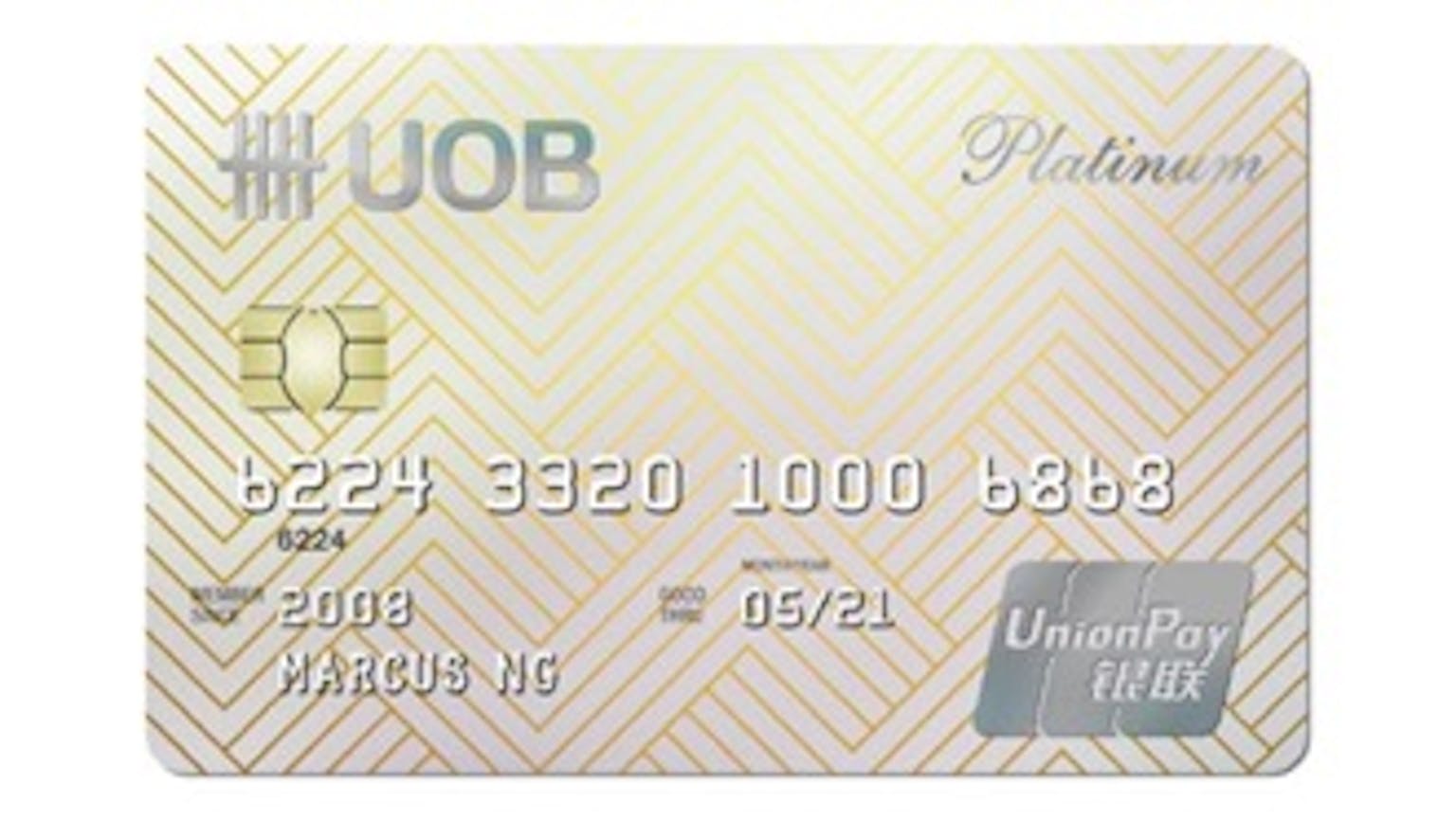

Products mentioned in this forum:

No Name

Yes it can, UnionPay network currently has been extended to a lot of countries and regions, including New Zealand, Hong Kong, Macao, Taiwan Region, Japan, Korea, Singapore, Malaysia, Thailand, Australia, USA, France, Germany, Britain, Switzerland, etc. In these countries ATMs and merchants are gradually connected to the UnionPay network. Due to local customs of some overseas countries and regions, UnionPay logo is only shown on the screens of ATMs that accept UnionPay Card, which requires particular attentions from cardholders. Besides, ATMs accepting UnionPay Card in some countries need to be identified by some bank logos.