What countries merchants and ATMs accept the UnionPay Card?

In what countries can my UnionPay Card work and be accepted by merchants and ATMs? I am putting finishing touches to our honeymoon and we plan to visit 3 countries which are Australia, France and Dubai.

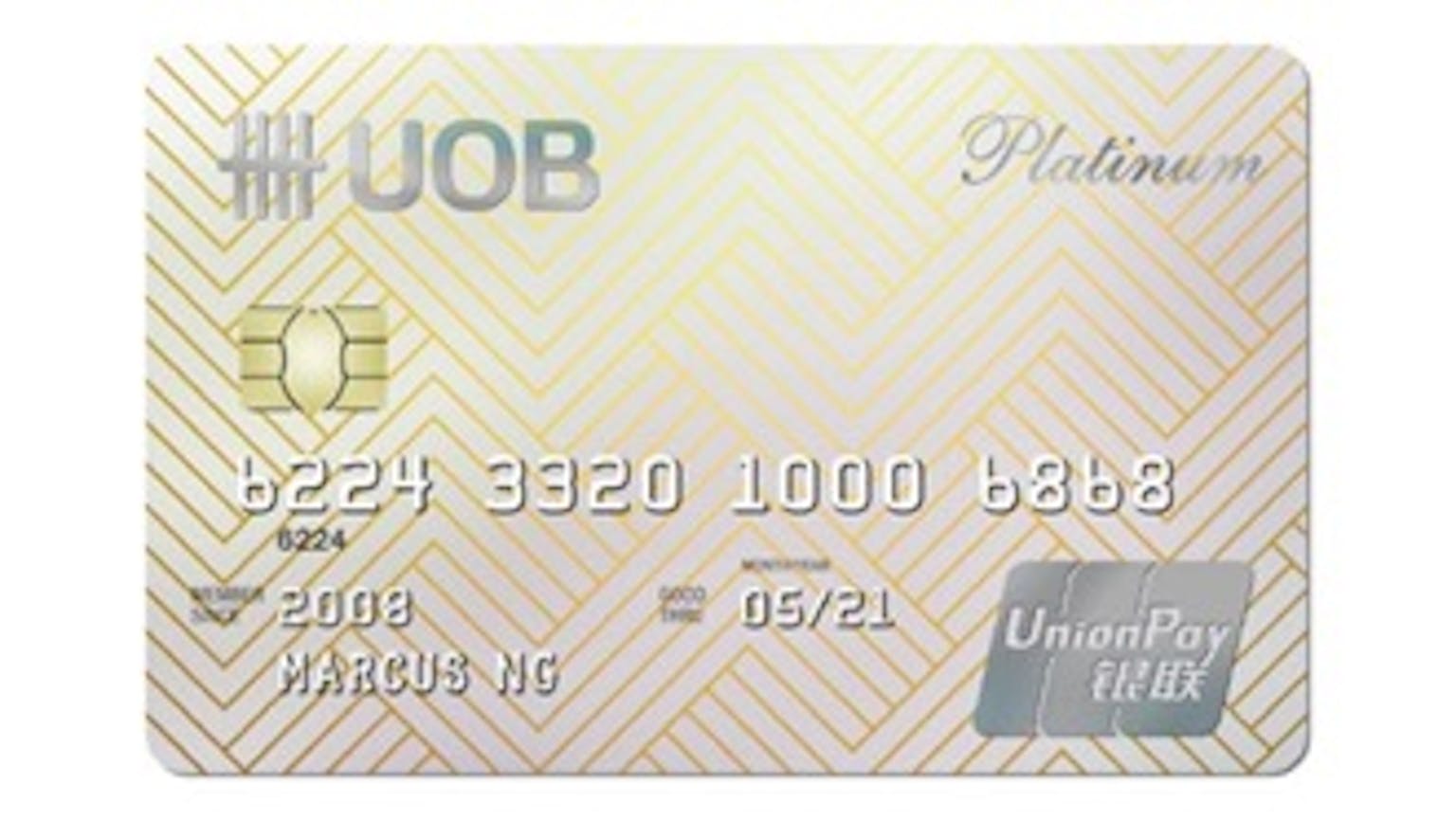

Products mentioned in this forum:

No Name

Currently, UnionPay network has been expanding into a lot of countries and regions, including Hong Kong, Macao, Taiwan Region, Japan, Korea, Singapore, Malaysia, Thailand, Australia, New Zealand, USA, France, Germany, Britain, Switzerland, etc. In these countries and regions, ATMs and merchants are gradually being connected to the UnionPay network. Therefore, not all ATMs and POS terminals accept UnionPay Card. But irrespective, UnionPay Cards can be accepted by all ATMs or POS terminals labelled with the UnionPay logo. Due to local customs of some overseas countries and regions, UnionPay logo is only shown on the screens of ATMs that accept UnionPay Card (such as in Europe), which requires particular attentions from cardholders. Besides, ATMs accepting UnionPay Card in some countries need to be identified by some bank logos. For details, cardholders can inquire the card-using tips for each country in “Global UnionPay Card”.