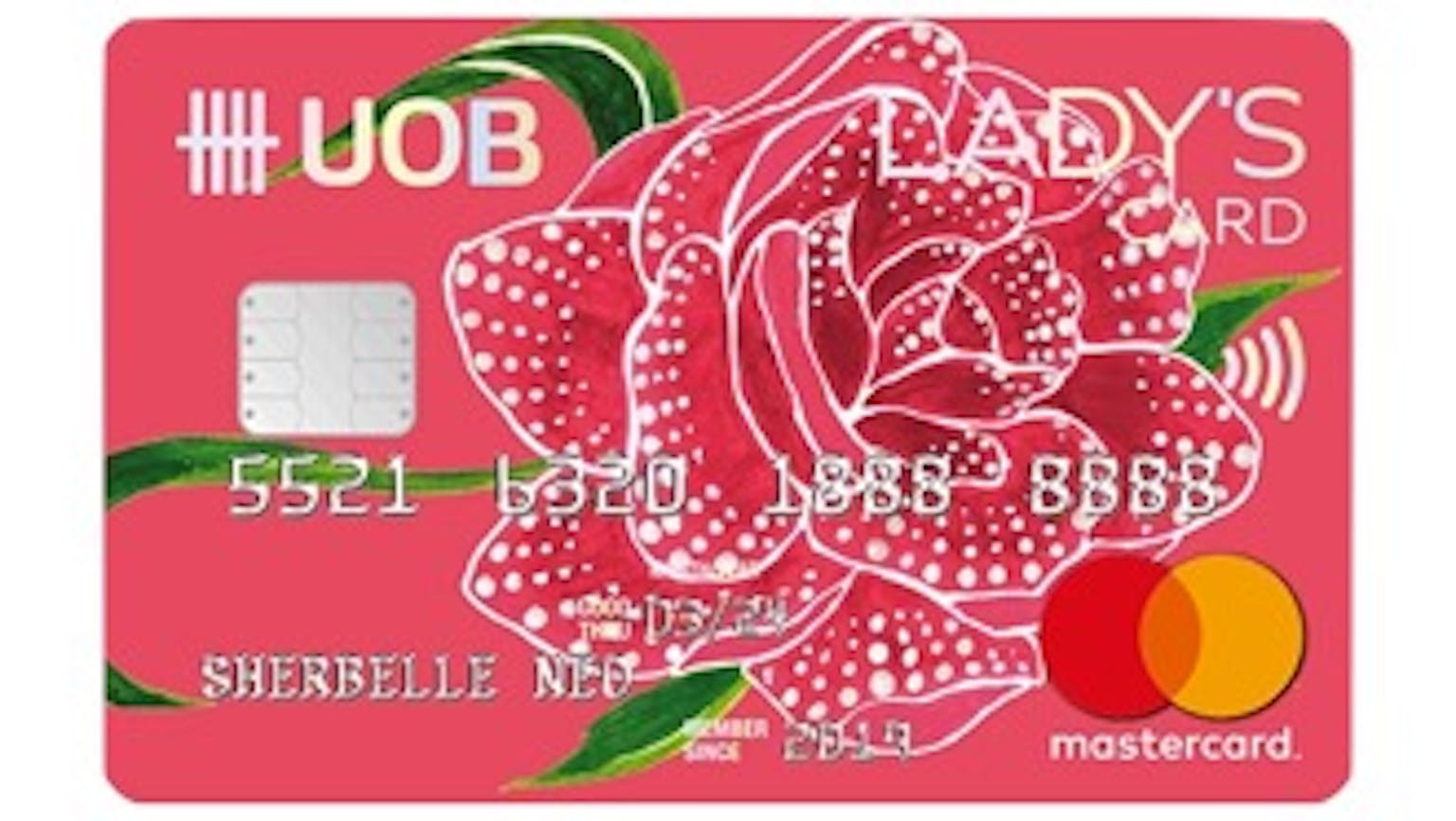

Why didn’t I earn 10X UNI$ for a particular purchase using my UOB Lady’s Card?

I made a transaction which I believe qualifies for the 10X UNI$ and it turns out I did not earn it as expected. My question therefore is why that should be the case, why did I not earn the 10X UNI$ reward?

Products mentioned in this forum:

No Name

Be advised that Transactions qualifying for 10X UNI$ depends on whether the merchant falls within the selected eligible categories. If its MCC falls within the approved MCCs or it is one of the eligible merchants that we recognise, you will earn 10x UNI$ for your purchases made at the store. However, if the merchant does not fall within any of the eligible MCCs you will not earn 10X UNI$ even if your transaction made contains for specific items relevant to the eligible categories as may have been the case with you.