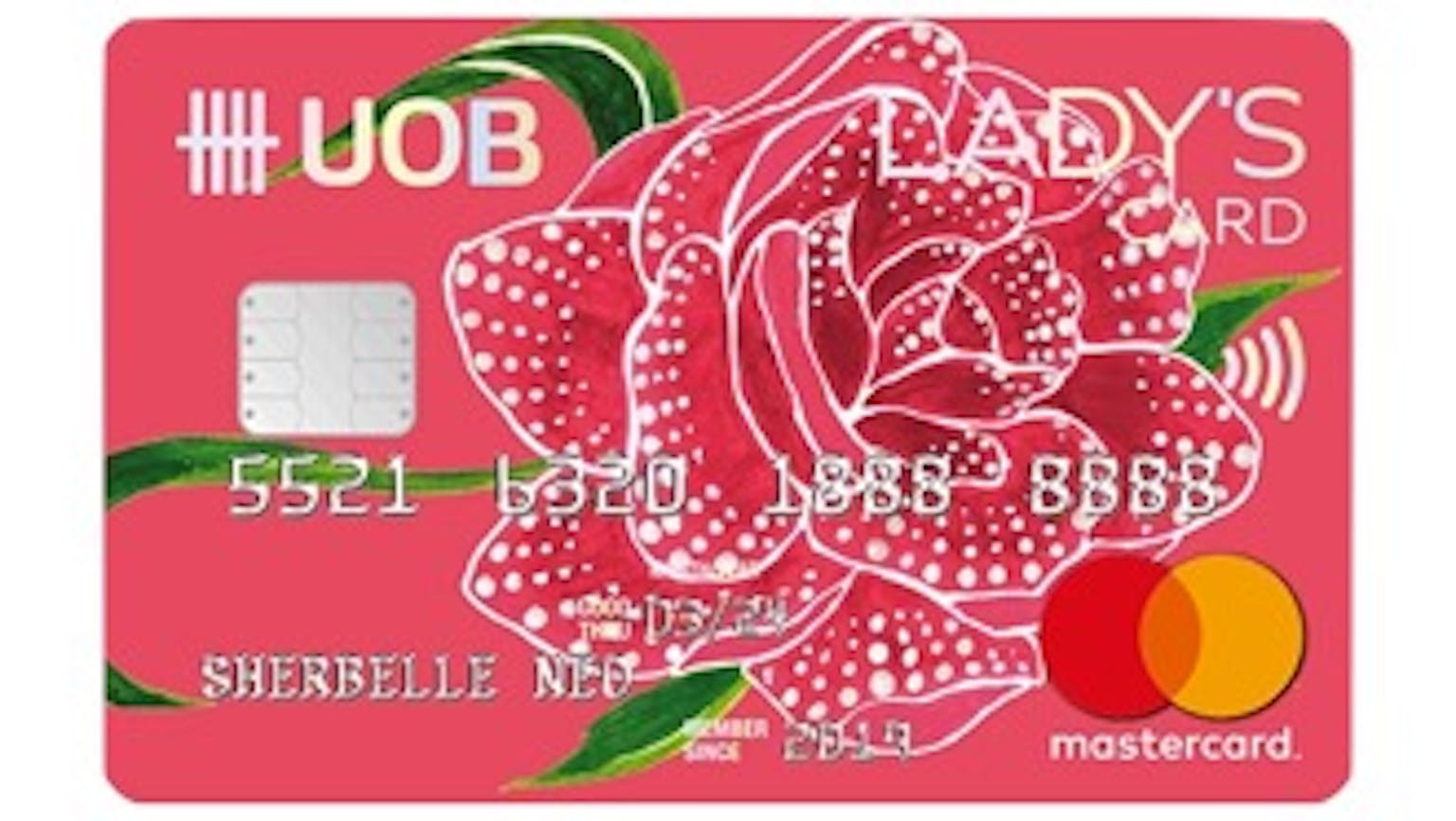

When do I start earning the 10X UNI$ on my selected categories with the UOB Lady’s Card?

Will I earn UNI$ if I do not select my preferred categories to earn Bonus 10X, and when exactly do I get to start earning the 10X UNI$ on my selected categories?

Products mentioned in this forum:

No Name

You will start earning your Bonus UNI$ upon enrolment of your preferred categories. Qualified transactions will be based on posting date and No, you will not earn Bonus UNI$ if you do not select your preferred categories. However, you can continue to earn 1X UNI$ for every S$5 spend on your UOB Lady’s Card going forward.