Can I change my Bonus UNI$ category or categories after I’ve selected them?

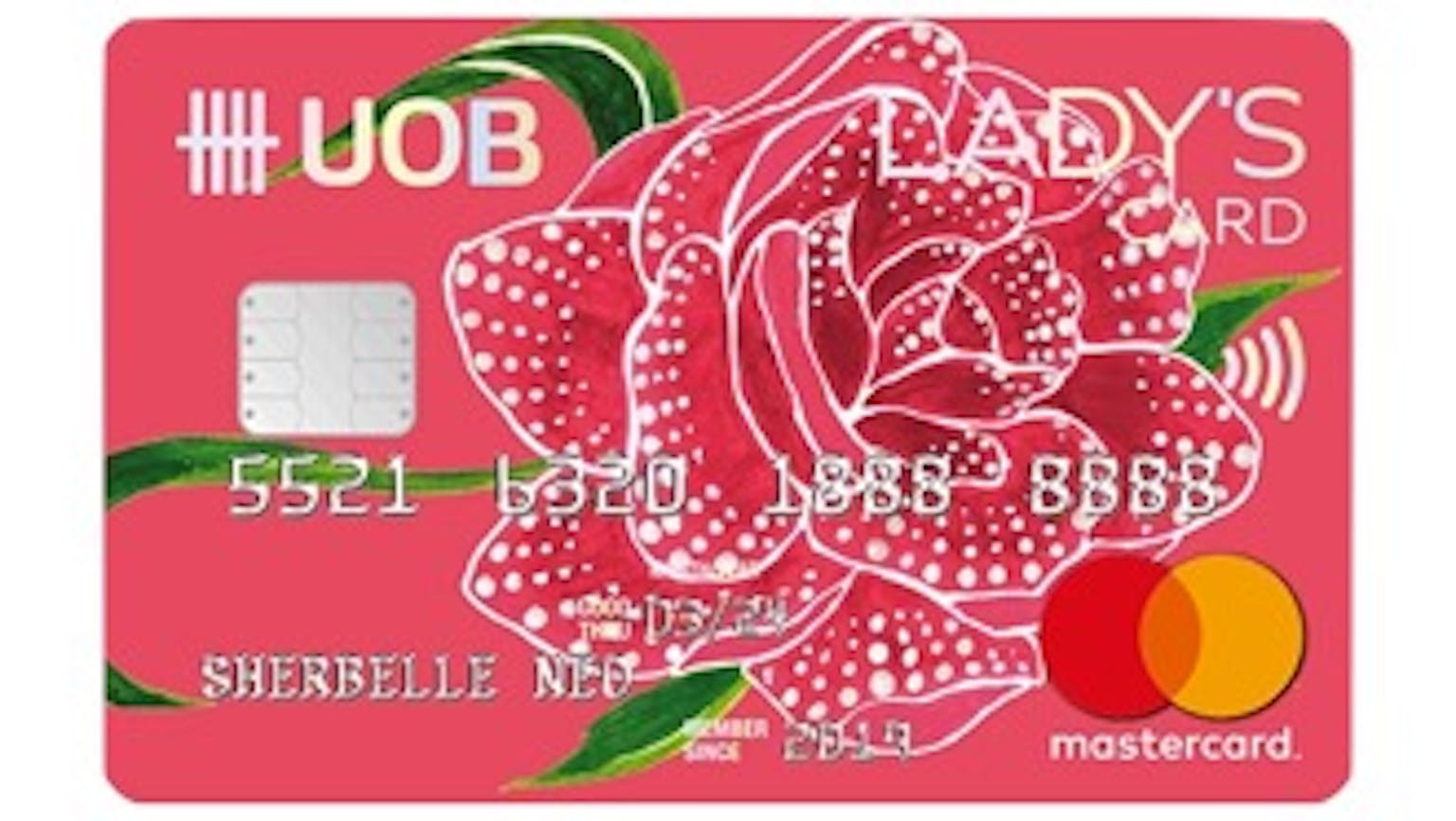

Does anyone here use the UOB Lady’s Card, I would like to know if I can change my bonus UNI$ category or categories as the case may be after I have selected them and do I need to make this choice every quarter?

Products mentioned in this forum:

No Name

If you have already chosen your preferred category or categories and then have a re-think and want to make changes, you may have to visit uob.com.sg/ladys-enrol to update your preferred category(S) which will take effect in the next new calendar quarter. The first entry takes effect as of date of enrolment while subsequent entries take effect the next quarter while the bank will take the last entry of category(S) for the new quarter Bonus UNI$ awarding.