Can I change again my categories for the next quarter after I previously selected them and later change my mind?

If I have selected my UOB Lady’s Card categories already for the next quarter but along the line I changed my mind about the category selections, can I still make changes on them again?

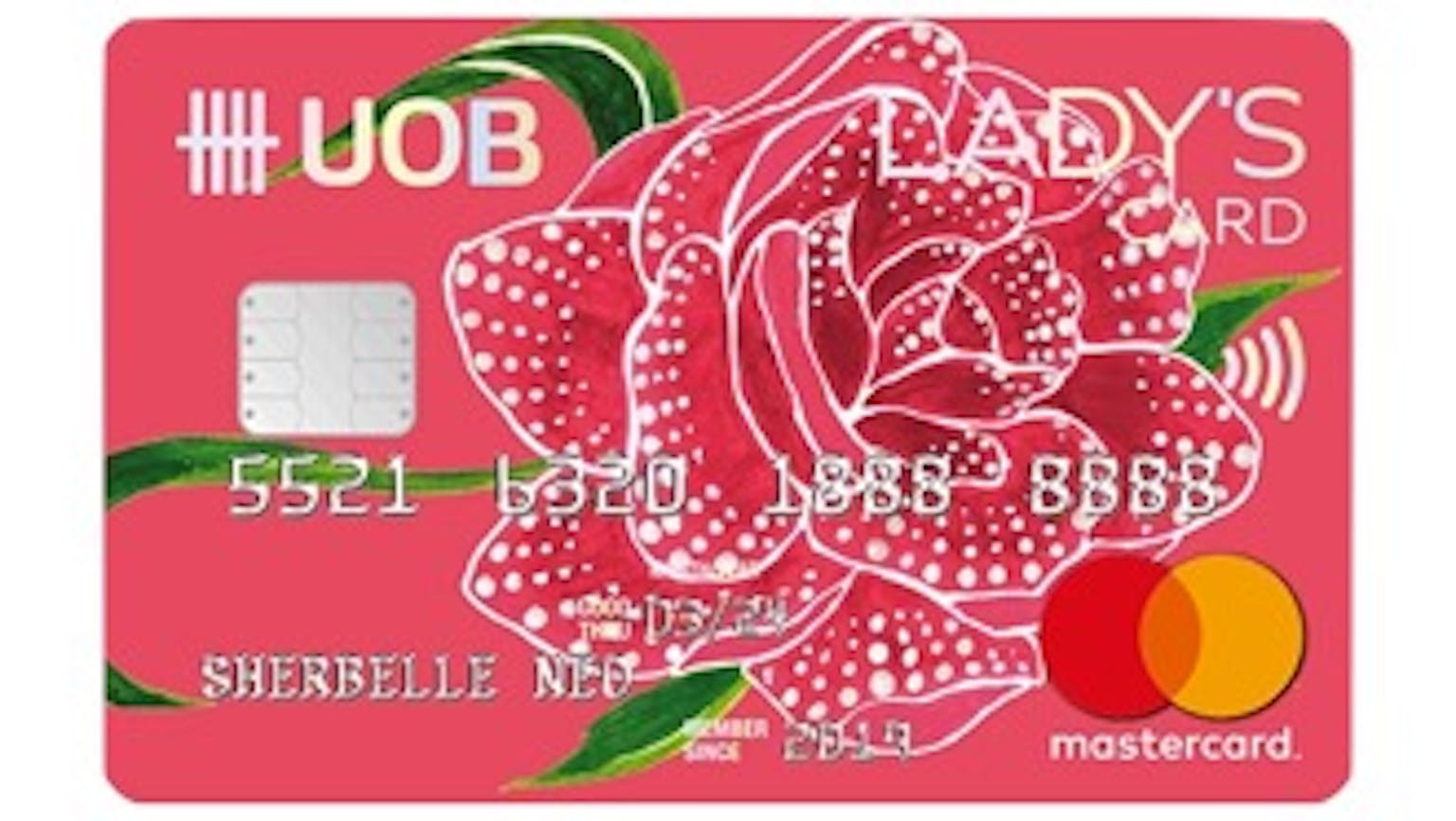

Products mentioned in this forum:

No Name

Yes you can as long as you enrolled before the start of the next new calendar quarter as the bank will take the last entry enrolled before the start of the new quarter to determine that Bonus categories) selection of the new quarter.