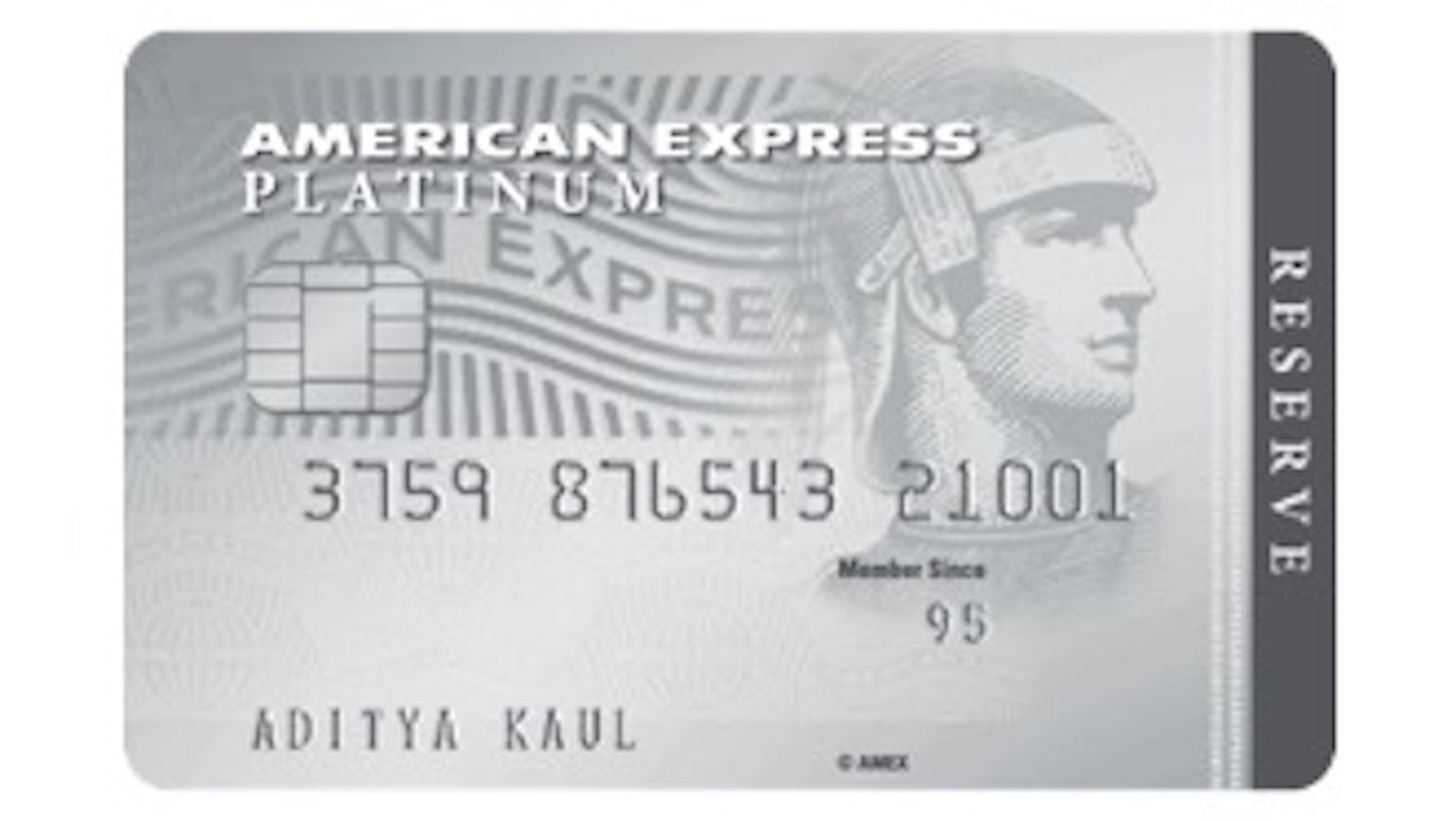

Please I would love to know if I can apply for the American Express Platinum Reserve Credit Card if the income I earn is a little over S$80,000 p.a?

I really want to up my card game up and I have my sights on the American Express Platinum Reserve Credit Card, can I apply for it if I earn about s$80,000 p.a? Would I be eligible?

No Name

Eligibility for application for the American Express Platinum Reserve Credit Card online requires that you are over 21 years old with an earning which provides you an income of over S$150,000 p.a. So unfortunately you will not be eligible for this card at this time.