Who can point out the benefits of the Amex Platinum Reserve Credit Card’s dining privileges?

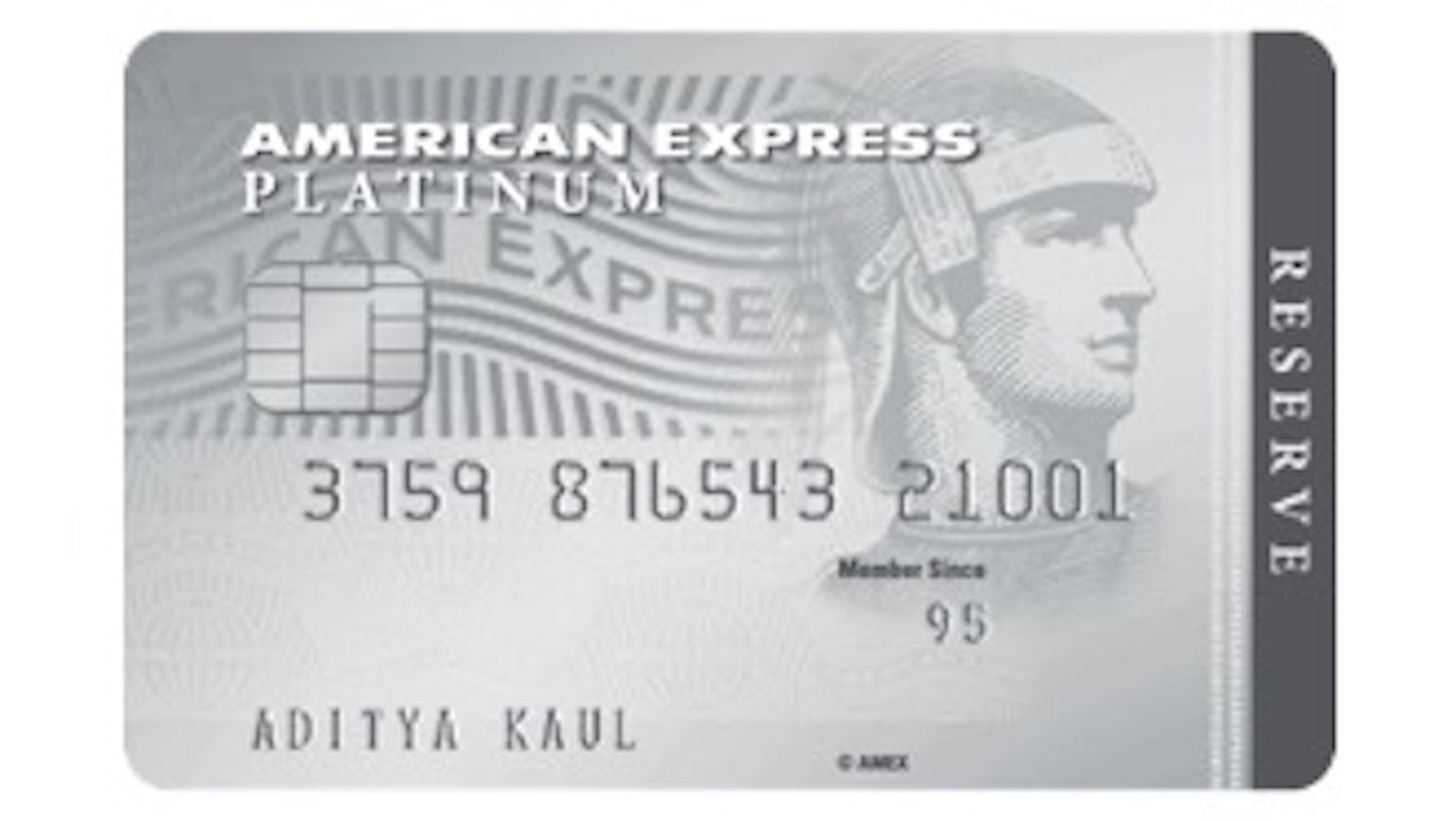

My girlfriend and I like dining out and I realised that we should make the most of it with the Amex Platinum Reserve card. Aside from the welcome offer of 50,000 membership reward points what is good with their dining packages?

No Name

. The Amex Platinum Reserve Credit Card offers up to 50% savings at a handpicked selection of popular restaurants island-wide in addition to savings of up to 50% on food bills for unlimited visits at selected 5 star hotels around Singapore. As an official Card Partner for Michelin Guide Singapore, you are assured of privileges of up to 50% savings at selected restaurants in some of the best luxury hotels in Singapore such as Fairmont Singapore, Swissôtel the Stamford Singapore, and Swissôtel Merchant Court. I recommend you take advantage of the Love Dining – Restaurants by checking out all the outlets under the Love Dining program at amex.co/lovedining.