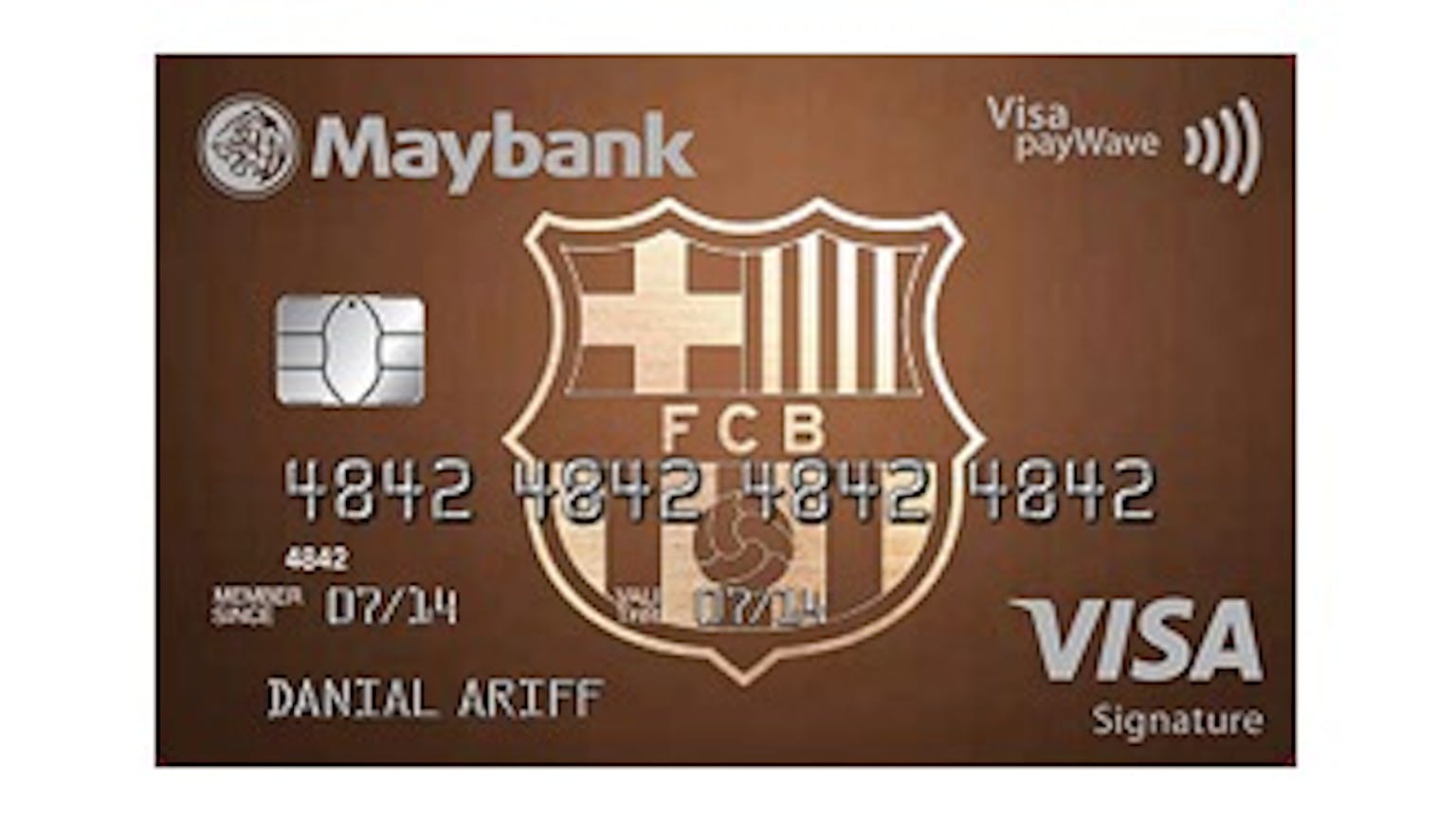

What documents does a foreigner need to get the Maybank FC Barcelona Visa Signature Card? really a partnership with the famous football club and what else is special about it?

I am a foreign worker in Singapore and a fan of FC Barcelona. The latter is a major reason why I am interested in the card, what documents will I require to make this possible?

Products mentioned in this forum:

No Name

The Maybank FC Barcelona Visa Signature Card is a first-class card in partnership with a world-class club. You can enjoy 1.6% Unlimited cash rebate on all local spend with no minimum spend and no cap and 2X TREATS Points with every dollar spent on foreign currency transactions. Plus you could even win a trip to watch FC Barcelona LIVE in Camp Nou every football season. As a foreigner you will require a photocopy of your NRIC (front and back), your latest 12 months' CPF contribution history or the latest computerised payslip or the latest Income Tax Notice of Assessment. In addition valid passport and employment pass (with at least 6 months' validity), utilities bill or bank statements with residential address and company letter stating proof of employment of at least 1 year. Hope this helps and you can make Nou camp someday soon.