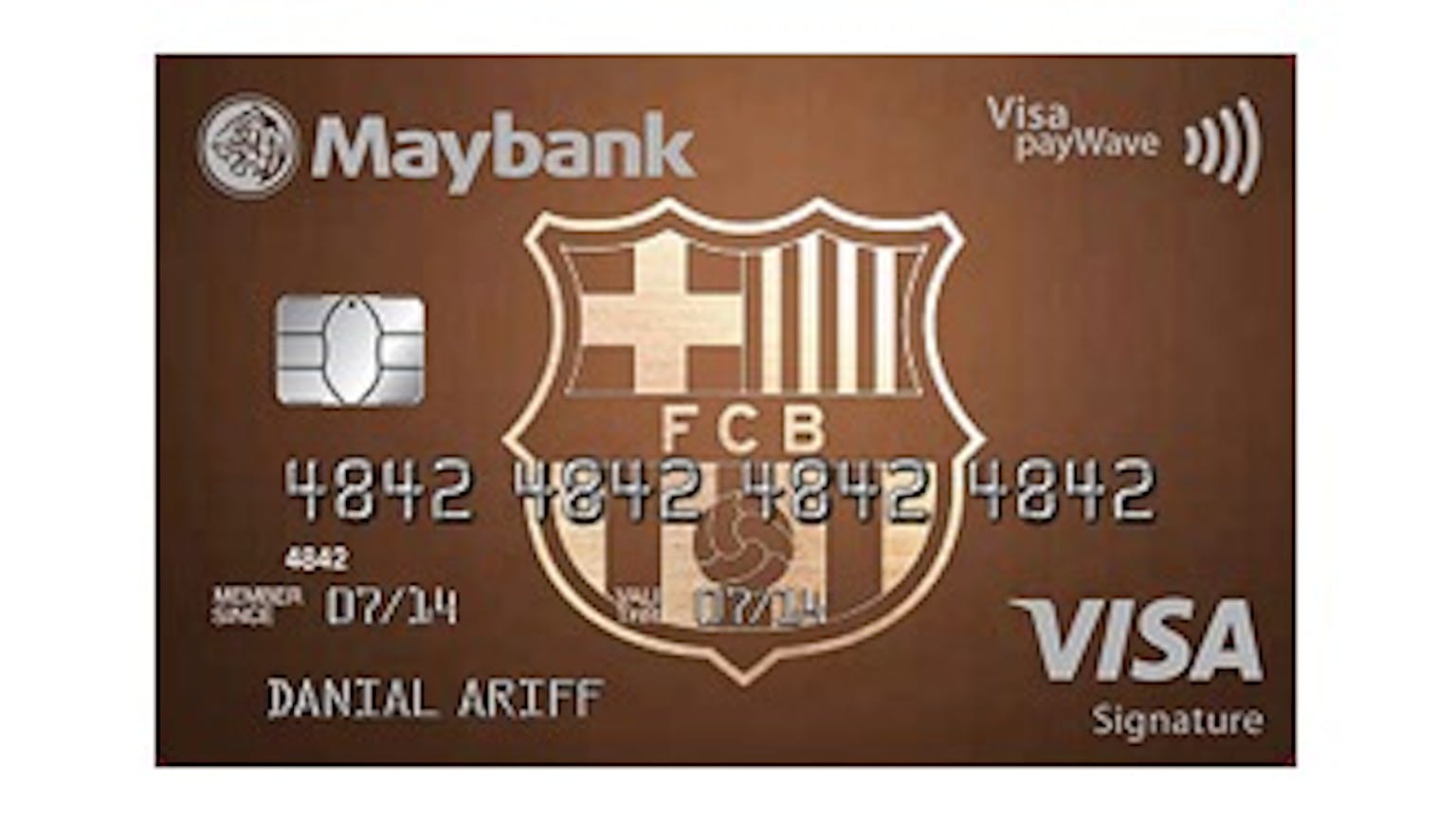

I am a foreigner, can I apply for the Maybank Credit Cards and CreditAble feature for my Maybank FC Barcelona Visa Signature Card?

I am aware that I can receive a complimentary American tourister luggage worth S$260 with Maybank credit cards and creditable but can I apply for it as a foreigner the first place?

Products mentioned in this forum:

No Name

Foreigners are eligible for this promotion and can do so by applying for new Maybank Credit Cards and charge a minimum of S$400 to your Credit Card for the first two consecutive months upon approval to be qualified for this promotion. You should apply as soon as possible as this promotion is based on first-come-first-served basis and is exclusive to first-time applicants. You get a 2-year annual fee waiver on FC Barcelona Visa Signature Card, Manchester United Platinum Visa Card and CreditAble