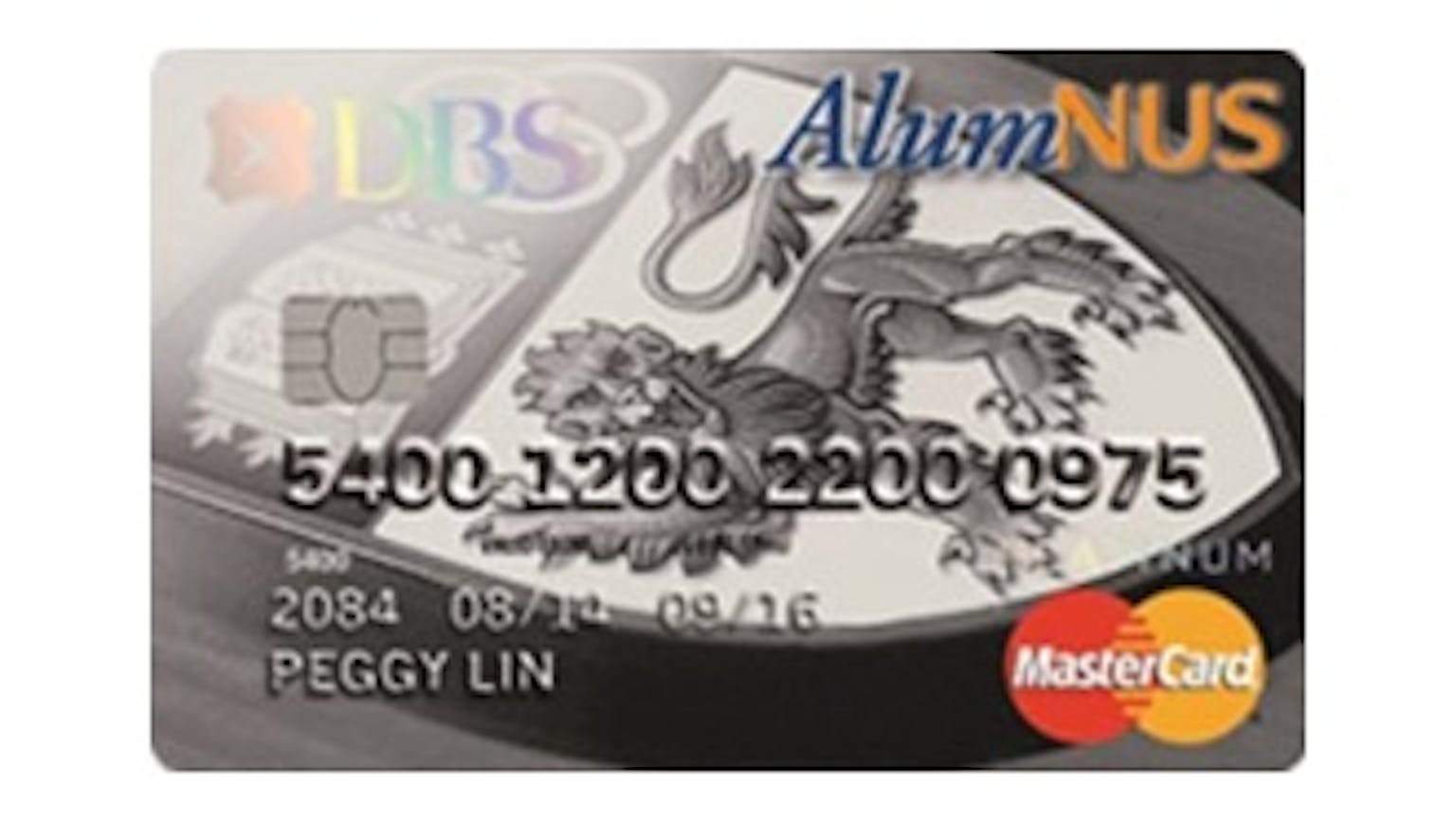

Do you use any of DBS NUS Alumni or DBS NUSS Card, is it really worth all the hype?

I have read quite a few good reviews about the DBS NUS Alumni & DBS NUSS Cards but are there really worth all the hype or is it just one of those here today and gone tomorrow card offerings?

Products mentioned in this forum:

No Name

I certainly think there are worth all the hype. The DBS NUS Alumni Card is basically a Credit Card packed with rewards that gives back to your alma mater each time you spend, with every transaction made on your DBS NUS Alumni Card, they make a contribution to support NUS students with bursaries and awards. The DBS NUSS Card on the other hand is essentially a membership card and credit card in one, which takes care of your NUSS bills while still providing you with exclusive Platinum privileges, DBS Rewards and dining offers. So yes the hype is worth it as you stand to gain as you indulge in entertainment, dining, shopping and wellness privileges on campus and island wide earning 1 DBS Rewards Point for every $5 you charge to your cards. With the DBS NUSS Card you can enjoy the convenience of a combined credit and membership card and Auto-charge NUSS bills to your Card while staying connected to the country’s foremost graduate society. I must also point out the complimentary annual fee waiver as long as you’re a NUSS Member. And if you are the jetsetter you can travel in style with NUSS enjoying complimentary access to premium airport lounges at Changi Airport.