Will the monthly deductions for Singtel GOMO be considered a credit card transaction? Or will it be considered a debit card transaction?

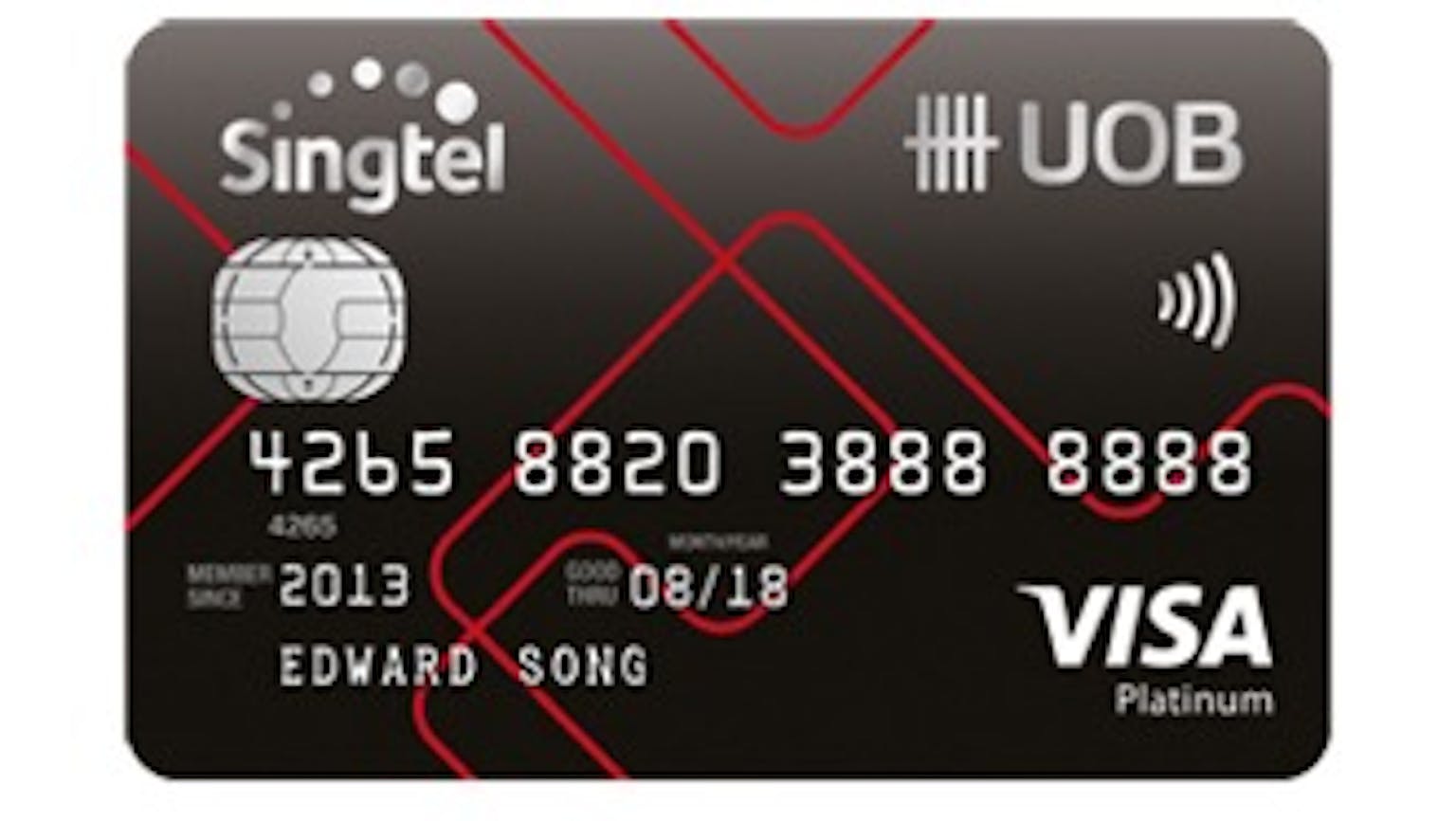

For the Singtel-UOB Card I heard that monthly bills are auto-deducted and there won’t be a bill to keep. In that case will the monthly deductions be considered a credit card transaction? Or will it be like a debit card one?

No Name

Depending on how you set up your card, you would have received an SMS indicating whether it is a debit or credit card transaction based on how you assigned it. However Singtel bill must be charged on a recurring basis to the Singtel-UOB Card. The first nominated Singtel account has to be in the name of the Principal Card member. Cash rebate will be awarded based on the monthly GOMO charges and consolidated Singtel bills posted in the card statement month.