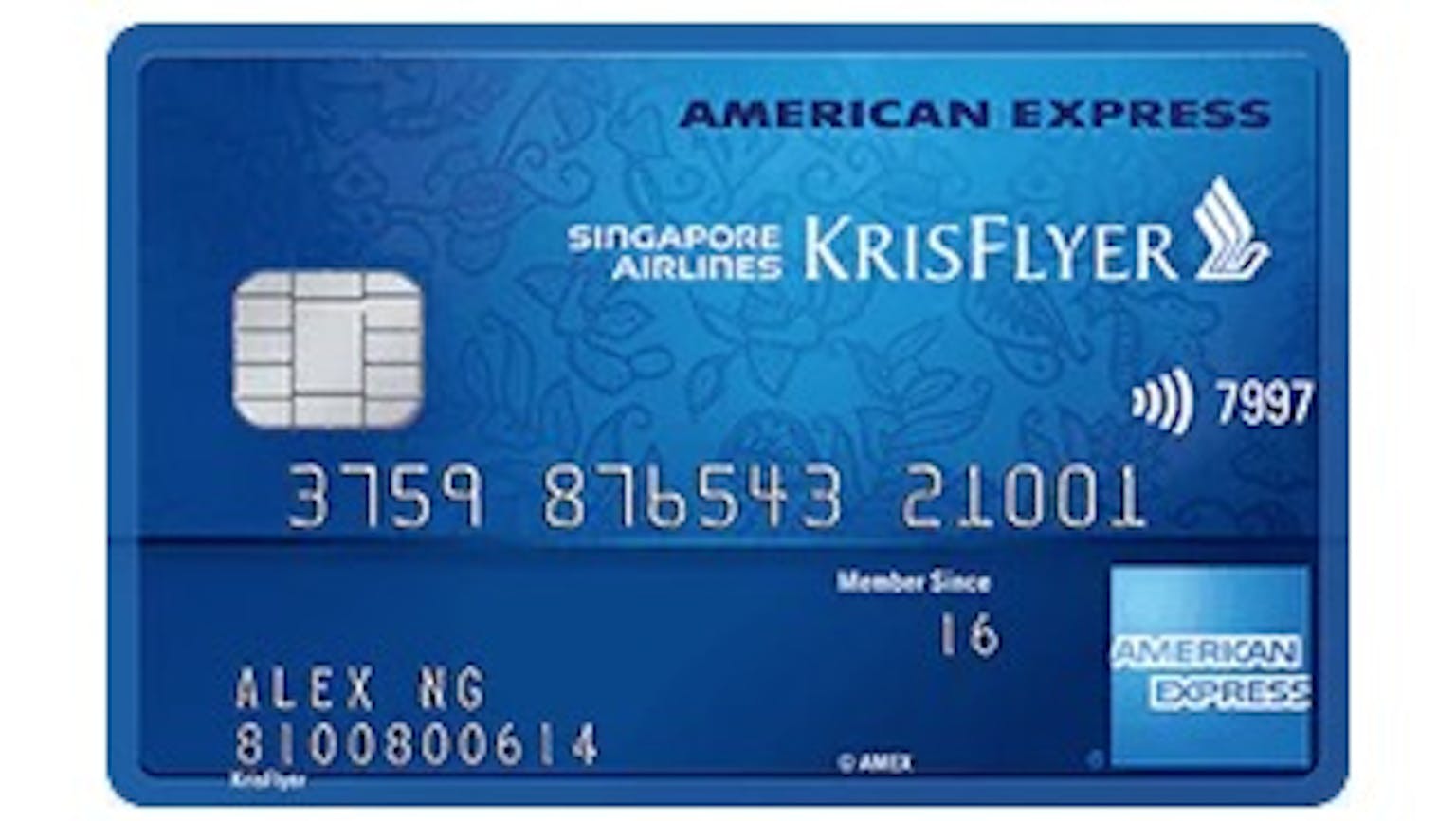

How does Amex Singapore Airlines KrisFlyer Credit Card waiver work and are there any criteria one needs to hit in order to be eligible for the waiver of annual fee?

Hi! I'm a fresh grad who just started working and applied for an Amex Singapore Airlines KrisFlyer Credit Card. Can anyone advise me on how the waiver of annual fees work? Are there any criteria or things one must do, to increase the likelihood of getting an annual fee waiver? My salary is rather low right now, so I'm really scared I have to pay the $100+ annual fee each year. Thank you!

No Name

Actually you can enjoy the first Year Fee for both you and your supplementary Card Members waived for the first year. But generally, as long as you are spending even minimally on the card and are credit worthy they would waive it for you. It shouldn't be a problem to waive your credit card annual fee so long as you don’t have multiple cards from a single bank as they may not let you waive until you cancel some of the cards.